Prices Jumping Across San Francisco

The San Francisco real estate market grew increasingly frenzied as the first quarter of 2014 progressed, leading to another surge in home prices in virtually every neighborhood in the city. The high-demand/ extremely-low-inventory/ competitive-bidding situation is similar to what occurred first in spring 2012 and then, to an even higher degree, in spring 2013. After the market seemed to stabilize in the second half of last year, we didn’t expect to see it turn this fierce in early 2014, but right now it appears to be every bit as ferocious as last spring’s. The bottom line: Already the second most densely populated city in the country, San Francisco simply has many more people wanting to live here than there are homes available to rent or buy.

Sales Over Asking

The heated competition for new listings coming on the market has resulted in an astounding percentage of sales occurring above, and often far above, list price.

This chart below breaks down, by neighborhood, the average sales price to list price percentage for the 90% of homes selling without price reductions. Of the areas assessed, Bernal Heights came out on top with sales prices averaging an incredible 21% over list prices over the past 2 months.

Far Too Little Inventory

When the market recovery began in earnest in early 2012, there were complaints of a shortage in inventory. In 2013, the market grew even more heated and supply declined further to what felt like desperately low levels. Now in 2014, amid no lessening of demand that we perceive, the supply of SF homes available to purchase has dropped again.

There are increasing numbers of new-construction housing units coming on market - and many more being planned and built - but so far they're being snapped up, at very high prices, without noticeably altering the supply and demand dynamic.

Listings Selling Faster than Ever

Median Sales Price Spikes

Typically, the first quarter of the year does not show a dramatic increase in median sales prices over the previous quarter – in fact, a decline in not unusual due to holiday market dynamics. But the first quarter of 2014 saw large spikes in median prices for both houses and, especially, condos in San Francisco.

This next chart is a look at quarterly median price appreciation over the past 3 years.

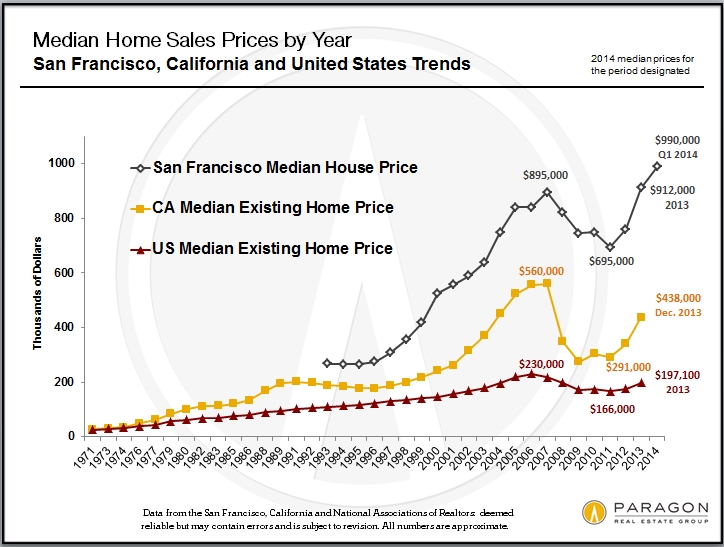

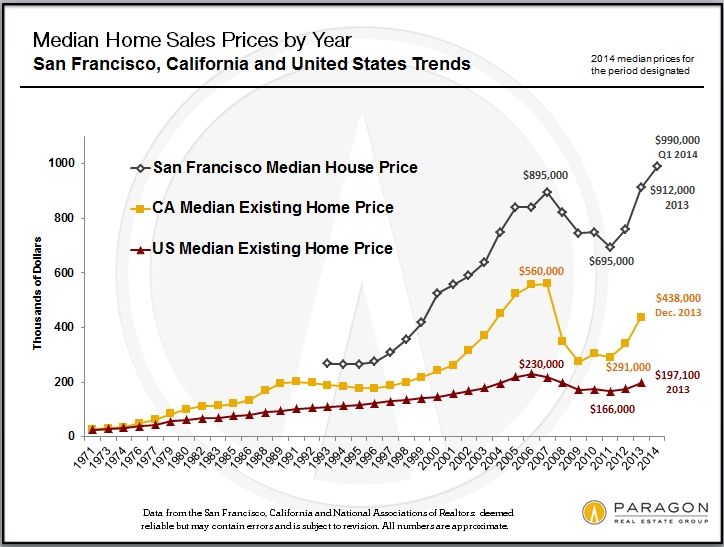

Longer-term trends: While virtually the whole country has been experiencing a large market rebound, San Francisco, because of our particular economic circumstances, is generally outperforming almost every other market area. The big exception is Silicon Valley, whose high home appreciation rate is being driven by many of the same employment and demographic causes as here in the city.

Please call or email if you have any questions or comments regarding these analyses.

Fluctuations in median and average sales prices and average dollar per square foot values are not unusual and these fluctuations can occur for other reasons besides changes in value, such as seasonality, inventory available to purchase, buyer profile and new condo development projects coming on market. How these statistics apply to any particular property is unknown without a specific comparative market analysis. All data from sources deemed reliable, but may contain errors and is subject to revision.

© 2014 Paragon Real Estate Group