Autumn Selling Season Begins

Real estate markets are essentially determined by the balance – or imbalance, as is often the case – between buyer demand and seller supply of homes to purchase. Underlying that dynamic are economic, political and demographic factors – some local, some not – such as population growth, employment, new home construction, high-tech booms, consumer confidence, interest rates, affordability, IPOs, stock market movements, shenanigans in Congress, and SF ballot proposals, to name a few. Even environmental factors, such as droughts and earthquakes, can jump in and affect the market. These factors are all jostling for effect, ebbing and flowing, sometimes appearing out of nowhere to shake things up, or suddenly shrinking and quickly forgotten. I am neither a blithe optimist, for whom boom times will never end, nor a inveterate pessimist, who see bubbles and crashes behind every shrub. For what it’s worth, based on Paragon's survey of current economic fundamentals, we don’t expect an imminent crash in the U.S. stock market or in Bay Area real estate values. (This short New Yorker article is excellent on recent market volatility: Drop in the Bucket) However, economies and markets naturally experience fluctuations – short-term ups and downs, times of slowing and flattening – and it’s certainly possible that the balance between buyers and sellers might shift, that the frenzy in our market may subside, and that home prices may plateau or even tick down to some degree. On the other hand, due to the scale of our high-tech boom (another area of exuberantly conflicting predictions) and our deeply inadequate supply of housing, demand may continue to exceed supply, and the pressures of recent years may continue until new-home construction makes a more significant contribution to inventory.

New Listings

September is usually the single month with the greatest number of new listings, and those that hit the market in the 4 to 5 weeks after Labor Day feed the vast majority of autumn sales activity until the market goes into hibernation mode in mid-late November. Preliminary indications are that this may be a very big new-listing month, even for a September. If this is true, and especially if it marks the beginning of a trend of more listings coming on market, that could cool the ferociously competitive, low-inventory, “seller’s market” of recent years. If buyers are more hesitant due to recent financial-market volatility, that would also cool the market. But, in our opinion, neither factor is likely to flip us into a crashing or recessionary market.

Bay Area Housing Affordability

The California Association of Realtors recently released its Housing Affordability Index (HAI) for the 2nd quarter of 2015. All Bay Area counties saw declines in their affordability index reading – which measures the percentage of households that can afford to buy the median priced single family dwelling (house) – and San Francisco is now only 2 percentage points above its all-time low of 8%, last reached in Q3 2007.

Where to Buy

We’ve recently updated our report on where one is most likely to find a house or condo in one’s price range. The chart above is 1 of 7 delineating San Francisco neighborhoods with homes from under $1 million to over $5 million:San Francisco Neighborhood Affordability

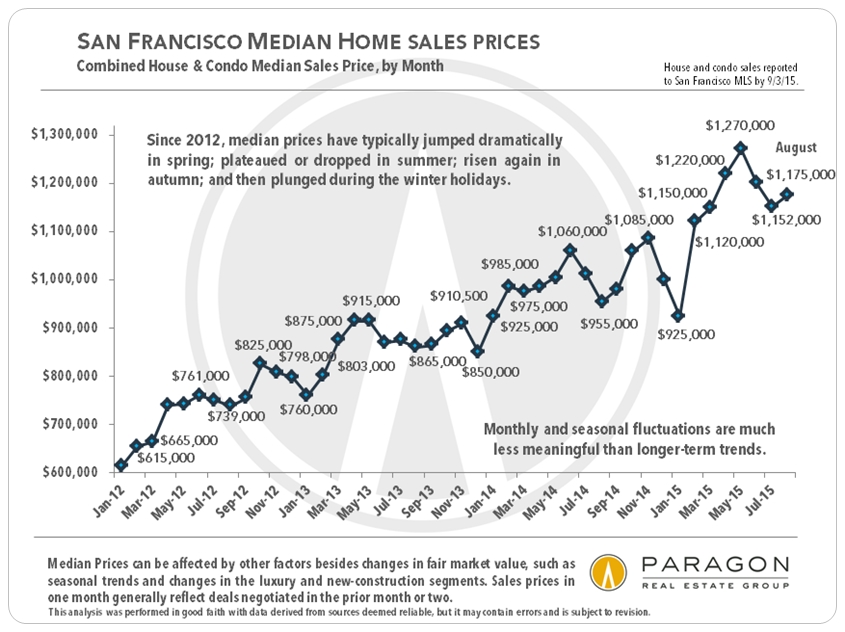

Median Home Prices

A glance at recent movements in San Francisco’s median home sales price, as well as at a few longer-term local and national economic indicators. Monthly fluctuations – often seasonally related – have been common since 2012, but home prices have consistently climbed higher over the longer term.

****************************************

Our goal is not to convince you of a certain position, but to provide you with what we believe to be reliable data, so that you can make your own informed decisions.

These analyses were made in good faith with data from sources deemed reliable, but they may contain errors and are subject to revision. Statistics are generalities and all numbers should be considered approximate. Sales statistics of one month generally reflect offers negotiated 4 – 6 weeks earlier.