December 2020 Market Report: A Strange Year Begins Winding Down

Though the pandemic upended many normal seasonal trends this year, the market did begin its typical “holiday season” slowdown in November. However, activity remained well above levels of last year. It is unknown how the latest Covid-19 circumstances may affect the market in December, which is usually by far the slowest month of the year.

This first chart tracks percentage changes in median house sales price since 1990. It is based upon the Q1 2000 price being indexed to 100: A reading of 50 signifies a median price half that in Q1 2000; 200 means the price has doubled since then. In early 1990, the SF median house price was about $300,000; it is currently running about $1,650,000.

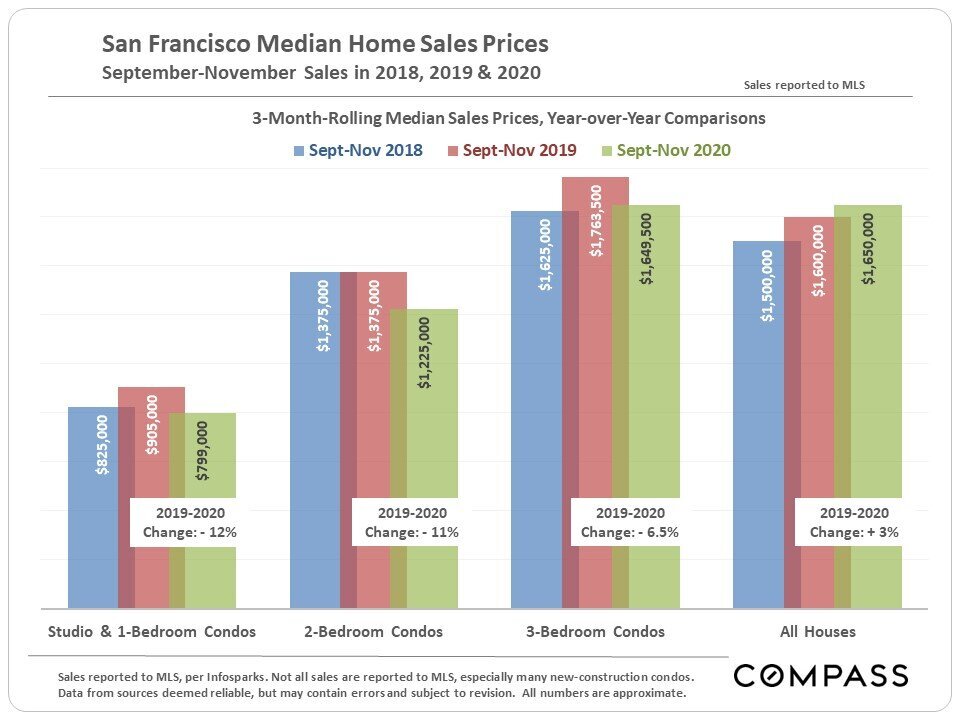

Year-over-year median sales prices for condos of various sizes, and for houses, in September through November of 2018, 2019 and 2020. A big increase in supply since the pandemic struck has led to declines in condo median sales prices.

A review of Q3 2020 median house sales prices (and SF condo prices) around the Bay Area. SF and San Mateo have been alternating in recent years for highest median house price. SF always has the highest median condo price in the region.

As is typical, the number of new listings plunged in November. In the first week of December - not illustrated on this chart - new listing activity ticked back up from the short Thanksgiving week, but remained well below pre-November numbers. December is usually the month with the lowest number of new listings coming on market.

With the decline in new listings, overall listing inventory dropped, but remained much higher than in previous years.

The number of condos on the market dramatically increased since the pandemic struck, but began to decline in November.

Market activity as measured by the number of listings going into contract is significantly higher on a year-over-year basis: over 40% higher than in November 2019.

The below chart measures demand as compared to the supply of listings available to buy. By this metric, the house market has been significantly stronger than the market for condos since the pandemic struck.

Monthly home sales volume by property type:

The number of listings reducing price dropped in November, but remained elevated over previous years.

4 charts and tables looking at the luxury home markets of San Francisco and those within the larger region. The luxury home market is fiercely seasonal in nature, but the pandemic upended some of the typical trends.

The Bay Area counties which have seen the largest percentage increases in the sales of luxury homes since May have been Sonoma and Santa Cruz (despite the fires), and Monterey. Not shown on this chart: Lake Tahoe saw a incredible 187% jump in luxury home sales.

This next table looks highest priced listings on the market in early November, and the highest priced sales in the May-October period. Since it was compiled, a higher sale closed in San Francisco, in the Sea Cliff neighborhood, at $24,000,000.

If you're looking for a home priced $5 million and above, these are the places where you will have the greatest choice of listings.

© Compass 2020 ¦ All Rights Reserved by Compass ¦ Made in NYC

Compass is a real estate broker licensed by the State of California operating under multiple entities. License Numbers 01991628, 1527235, 1527365, 1356742, 1443761, 1997075, 1935359, 1961027, 1842987, 1869607, 1866771, 1527205, 1079009, 1272467. All material presented herein is intended for informational purposes only and is compiled from sources deemed reliable but has not been verified. Changes in price, condition, sale or withdrawal may be made without notice. No statement is made as to accuracy of any description. All measurements and square footage are approximate. Equal Housing Opportunity.