December 2021 Market Report

Image by ~jar{} on Flickr via Creative Commons license.

November and December typically see very significant seasonal slowdowns in market activity, and in January, we will issue our 2021 market review, looking back at what has certainly been one of the highest demand markets in history. In the meantime, this report will look at:

The biggest Bay Area home sales of 2021 YTD, and the highest-priced listings currently on the market

Median home price appreciation by property type and bedroom count

What kind of home would $5 million buy you in 2021

Monthly supply and demand indicators reviewing trends in new and active listings, listings going into contract, price reductions, and overbidding

General market and luxury home sales trends by month

What it costs and what you get when buying a 4+ bedroom, 3500+ sq.ft. house in markets around the Bay Area

Any general compilation of sales and any statistics based upon them will include properties of radically varying location, age, architecture, quality, condition, square footage, lot size and amenities (views, pools, vineyards, decks, security system, guest quarters, etc.). This report illustrates broad market trends, which may or may not be applicable to any particular property. Created in good faith, based on data deemed reliable, but may contain errors and subject to revision. All figures should be considered approximate.

Highest Priced Home Listings on Market in the Bay Area & Tahoe*

Highest Priced Home Sales in 2021 YTD, by County/Region*

* Active/pending-sale listings posted to NORCAL MLS® ALLIANCE as of November 24, 2021. Sales reported to MLS in 2021 through late November 2021. Not all listings/sales are posted/reported to MLS. Off-MLS listings/sakes may exist with higher prices. Data from sources deemed reliable, but may contain errors and subject to revision.

That’s right — if you’ve got $46MM to spare, 2582 Filbert Street can be yours.

San Francisco Home Sales Change*

Percentage Increase in Sales Volume by Price Segment

* Comparing house, condo, co-op, TIC, townhouse unit sales reported to NORCAL MLS® ALLIANCE in the first 10 months of 2021 with the same period of 2019, per Infosparks. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate. Not all sales are reported to MLS.

Comparing home sales in 2021 YTD with the same period of 2019*

Since 2020 was a very unusual market, upended by the pandemic, this analysis compares 2021 YTD sales with the same period of the pre-pandemic year of 2019.

Home sales in the highest price segments saw percentage increases much larger than the market as a whole. One factor was appreciation, but another was the 60% disproportionate surge in the sale of luxury homes since the pandemic hit.

San Francisco Median House Sales Prices - by Bedroom Count

Monthly Median Sales Prices since 2018 - 6-Month Rolling Figures

Median sales price is that price at which half the sales occurred for more and half for less. It is a very general statistic often affected by factors other than changes in fair market value. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate.

The bigger the better: While all SFR sales are trending up, that fourth bedroom really seems to put prices up over the top.

San Francisco Median Condo Sales Prices - by Bedroom Count

Monthly Median Sales Prices since 2018 - 6-Month Rolling Figures

Median sales price is that price at which half the sales occurred for more and half for less. It is a very general statistic often affected by factors other than changes in fair market value. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate.

Condo median prices have not seen the high appreciation rate of houses since the pandemic, though they rebounded in 2021 from their 2020 decline.

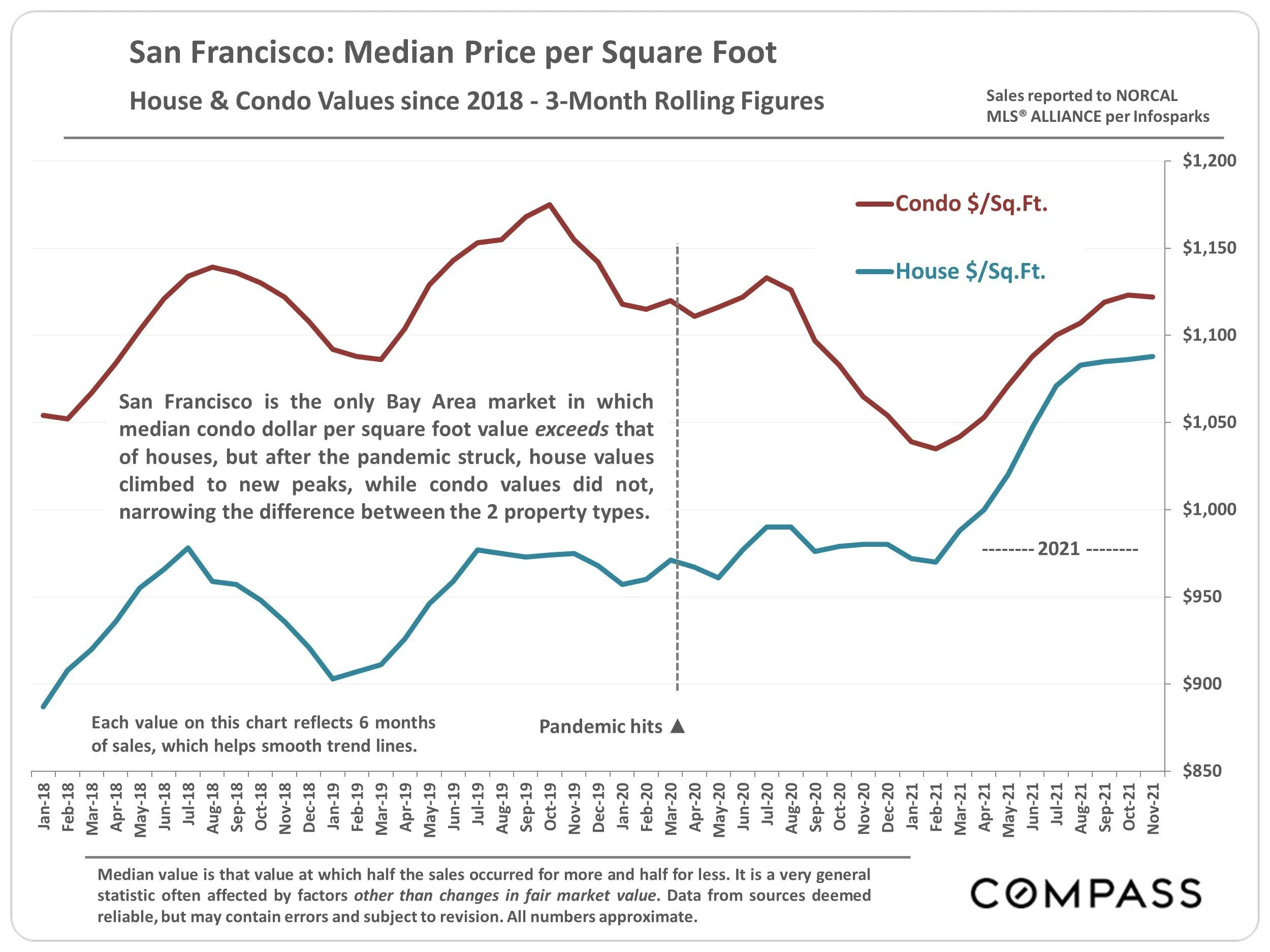

San Francisco: Median Price per Square Foot

House & Condo Values since 2018 - 3-Month Rolling Figures

Median value is that value at which half the sales occurred for more and half for less. It is a very general statistic often affected by factors other than changes in fair market value. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate.

San Francisco is the only Bay Area market in which median condo dollar per square foot value exceeds that of houses, but after the pandemic struck, house values climbed to new peaks, while condo values did not, narrowing the difference between the 2 property types.

What You Get for about $5,000,000 in San Francisco

A Sampling of 2021 Sales*

Ashbury Heights

House, built 1947 | 4BR/4BA | 3160 sq.ft. | $1581/sq.ft.

"Modern residence; lovely back yard; 2-car garage; hot tub; large roof deck wBR/views"

Haight Ashbury

House, built 1893 | 5BR/5.5BA | 4270 sq.ft. | $1170/sq.ft.

"Resplendent, renovated 1893 Victorian; decks, terraces, patios; 3-car garage"

Lake Street

House, built 1960 | 4BR/4.5BA | 3630 sq.ft. | $1376/sq.ft.

"Renovated single-family home; intuitive floorplan, designer finishes throughout"

Lower Pacific Heights

House, built 1885 | 4BR/3.5BA | 3711 sq.ft. | $1347/sq.ft.

"1885 Stick-Style Victorian restored & remodeled; media room, 1 car garage"

Marina

House, built 1929 | 4BR/3.5BA | 2675 sq.ft. | $1850/sq.ft.

"Renovated 3-level home steps to Marina Green; large lot; deck; garden; 2-car garage"

Noe Valley

House, built 2003 | 4BR/5.5BA | 4120 sq.ft. | $1189/sq.ft.

"4 en-suite bedrooms; giant garage; aBR/c system; electric car charger"

Pacific Heights

Townhouse, built 2016 | 3BR/3.5BA | 3006 sq.ft. | $1663/sq.ft.

"Gorgeous design, brilliant floorplan; sky lounge & terrace, stunning west views"

St. Francis Wood

House, built 1918 | 5BR/3.5BA | 4005 sq.ft. | $1223/sq.ft.

"Stunning Arts & Crafts style by archit. H. Gutterson; double lot; 2 car parking"

Sea Cliff

House, built 1951 | 4BR/3BA| 3100 sq.ft. | $1611/sq.ft.

"Modern home beautifully remodeled in 2019; south-facing garden; 2-car garage"

South Beach

Condo, built 2018 | 3BR/3.5BA | 5223 sq.ft. | $957 /sq.ft.

"Lumina 2-level, corner penthouse custom shell wBR/270 degree views, 3-car parking"

Yerba Buena

Condo, built 2018 | 2BR/2.5BA | 2013 sq.ft. | $2452/sq.ft.

"181 Fremont; brand new; exquisite finishes; 500 ft in the sky, stunning views"

Bay Area & Tahoe Luxury Home Sales

12 Months Sales, Priced $5 Million+, by County/Region

Any general compilation of sales will include properties of radically varying location, quality, condition, square footage, lot size and amenities (views, pools, vineyards, decks, etc.).

Does not include sales unreported to MLS: some luxury home sales are not reported. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and late reported sales may alter them. Figure for Tahoe region reflects 12 months through Oct. 2021, per Broker Metrics.

Buying a Large Home in the Bay Area

Median Sales Price, Home & Lot Size: 4+ Bedroom, 3500+ Sq.Ft. Houses*

Any general compilation of sales will include properties of radically varying location, quality, condition, square footage, lot size and amenities (views, pools, vineyards, and so on). Larger homes are more likely to be located in more expensive areas.

San Francisco Luxury HOUSE Market since 2018

3-Month-Rolling Sales Volume, Homes Selling for $3 Million+* Q2 2021

*Sales reported to NORCAL MLS® ALLIANCE per Infosparks: Not all sales are reported. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate and may change with late-reported sales.

The luxury market usually heats up rapidly through spring (Q2), slows in summer, spikes up in fall, and plunges in mid-winter. (The pandemic changed that dynamic in 2021.). Sales closing in one month mostly reflect market activity in the previous month.

San Francisco Luxury CONDO & CO-OP Market since 2018

3-Month-Rolling Sales Volume, Homes Selling for $2 Million+*

*Reflecting condo, co-op, townhouse and TIC sales reported to NORCAL MLS® ALLIANCE, per Infosparks: Some new-project condo sales are not reported to MLS. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate and may change with late-reported sales.

Sales typically ebb and flow according to seasonal patterns. Sales closing in one month mostly reflect market activity in the previous month.

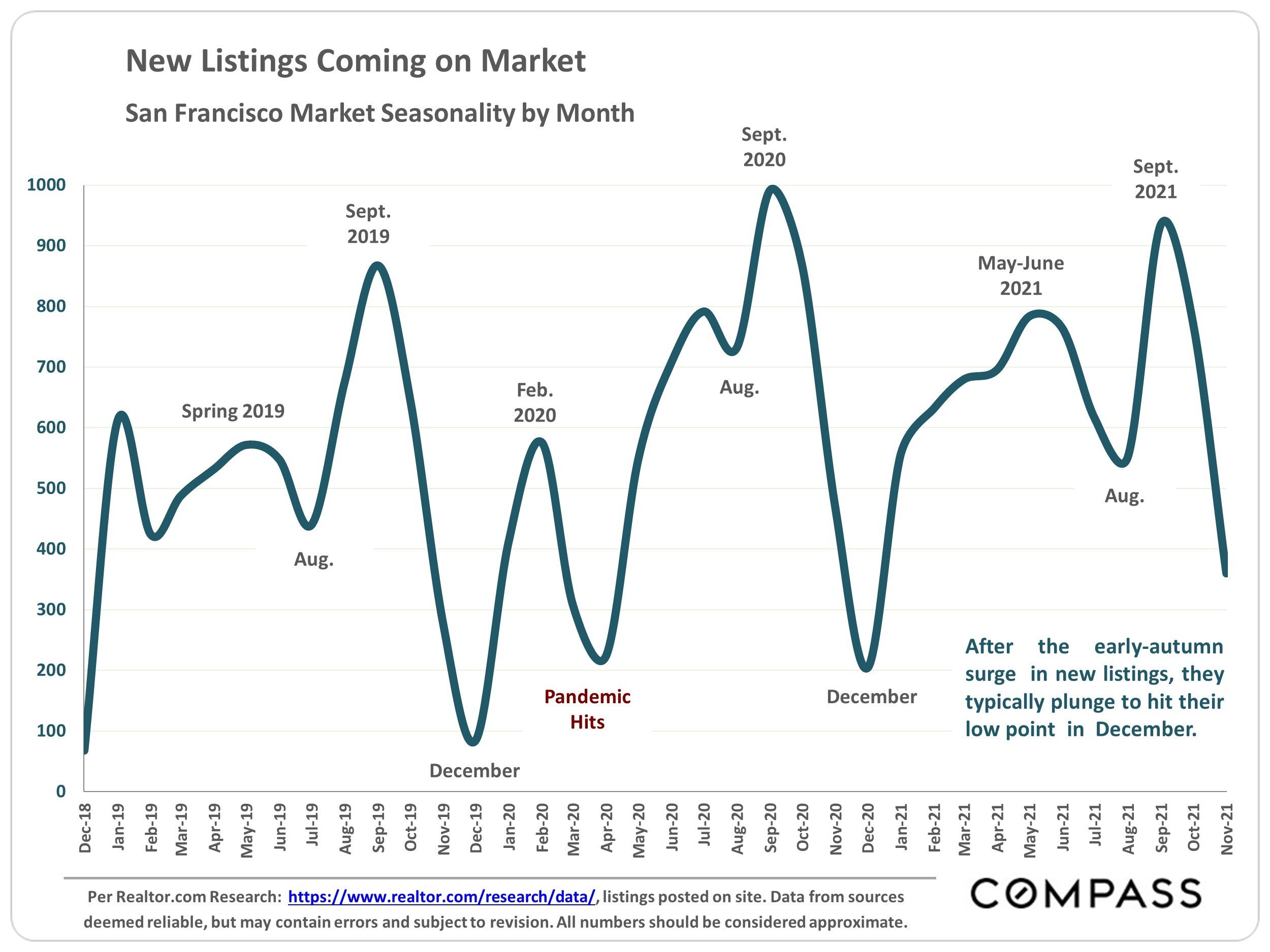

New Listings Coming on Market

San Francisco Market Seasonality by Month

Per Realtor.com Research: https://www.realtor.com/research/data/, listings posted on site. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers should be considered approximate.

After the early-autumn surge in new listings, they typically plunge to hit their low point in December.

Active Listings on Market

San Francisco Real Estate Market Dynamics

Per Realtor.com Research: https://www.realtor.com/research/data/, listings posted on site. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers should be considered approximate.

This is a snapshot measure of how many active listings can be expected on any given day of the specified month.

The number of active listings on a given day is affected by 1) how many new listings come on market, 2) how quickly buyers snap them up, 3) the sustained heat of the market over time, and 4) how many sellers pull their homes off the market without selling. The number typically ebbs and flows by season.

Well down from its post-pandemic peak in inventory, the current level is still somewhat higher than normal.

San Francisco Market Dynamics & Seasonality

Listings Accepting Offers (Going into Contract) by Month

Houses, condos, co-ops and TICs as listed in NORCAL MLS® ALLIANCE, per Infosparks. Does not include many new-project condo listings and sales not reported to MLS. Data from sources deemed reliable but may contain errors and subject to revision. All numbers are approximate. Last month estimated based on available data: Late reported activity may change this number.

After the early-autumn bounce in activity, the number of homes going into contract typically declines rapidly to hit its low point in December/January.

San Francisco Demand vs. Supply

Percentage of Active Listings Going into Contract, by Month

Residential sales data reported to SFARMLS, per Broker Metrics

This chart reflects all residential properties, but since the pandemic, the percentage of houses going into contract has been significantly higher than the % of condos, though both saw big rebounds in 2021.

This statistic measures the strength of buyer demand against the supply of listings available to purchase. The higher the percentage, the tighter the balance between supply and demand.

Overbidding List Prices in San Francisco

Percentage of Home Sales Closing over List Price, since 2018

3-month rolling sales data reported to NORCAL M LS° ALLIANCE, per Infosparks

Reflecting the percentage of sales closing at sales prices over the final list prices. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate, and may change with late-reported sales.

Another indicator of buyer demand vs. the supply of listings available to purchase is the percentage of sales that sell above asking price. The HOUSE market has seen higher demand than the CONDO market, but both heated up rapidly in 2021.

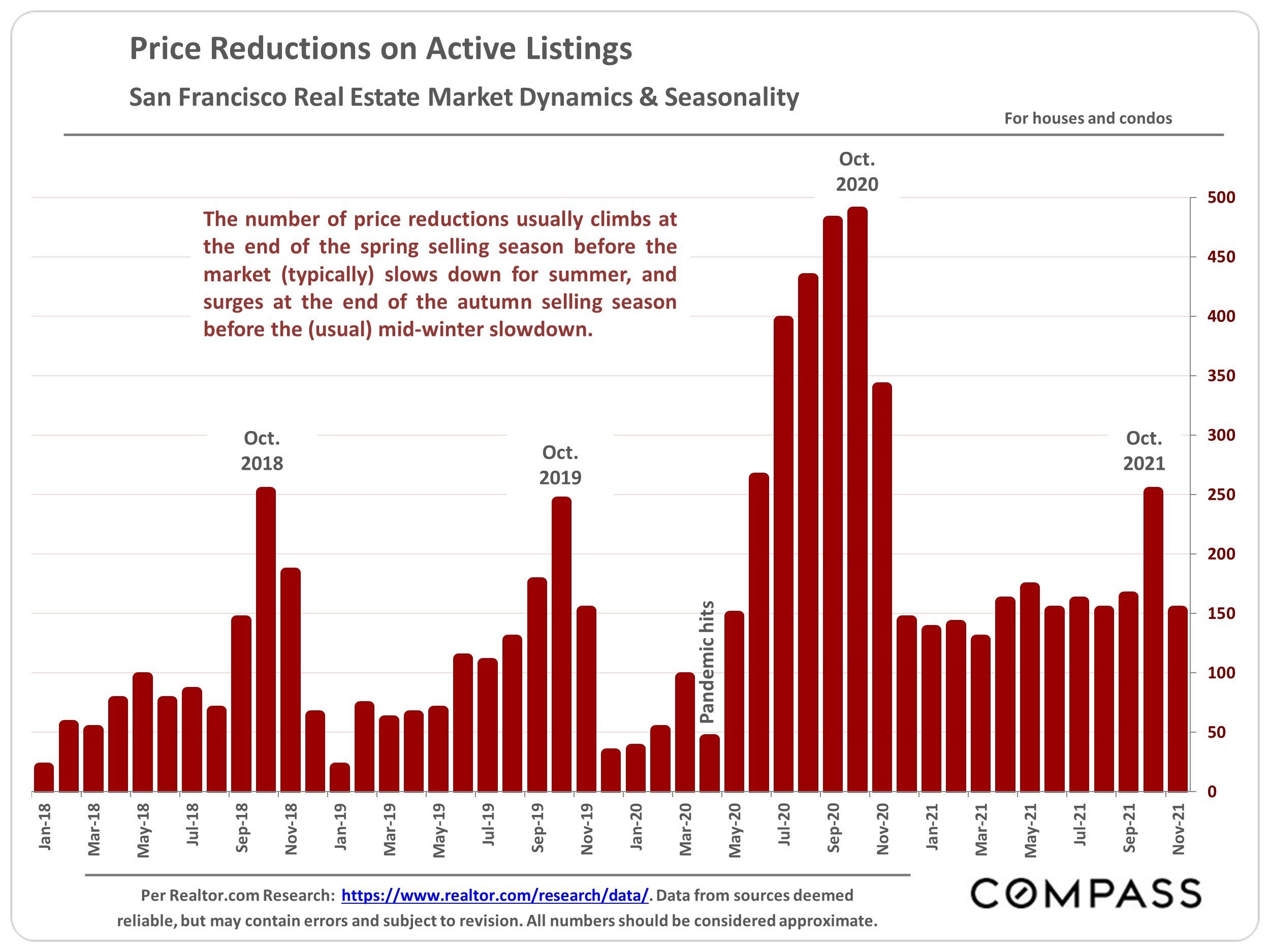

Price Reductions on Active Listings

San Francisco Real Estate Market Dynamics & Seasonality

For houses and condos

Per Realtor.com Research: https://www.realtor.com/research/data/. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers should be considered approximate.

The number of price reductions usually climbs at the end of the spring selling season before the market (typically) slows down for summer, and surges at the end of the autumn selling season before the (usual) mid-winter slowdown.

Unit Home Sales by Month since 2018

San Francisco Market Dynamics & Seasonality

Sales reported to NORCAL MLS® ALLIANCE, per Infosparks

Activity reported to NORCAL MLS® ALLIANCE, per Infosparks. Data from sources deemed reliable but may contain errors and subject to revision. All numbers are approximate. Last month estimated based on available data.

Sales volume usually ebbs and flows by season, and sales closing in one month mostly reflect accepted offers in the previous month: The low point in January mostly reflects the usual, big market slowdown in December.

Statistics are generalities, essentially summaries of widely disparate data generated by dozens, hundreds or thousands of unique, individual sales occurring within different time periods. They are best seen not as precise measurements, but as broad, comparative indicators, with reasonable margins of error. Anomalous fluctuations in statistics are not uncommon, especially in smaller, expensive market segments. Last period data should be considered estimates that may change with late-reported data. Different analytics programs sometimes define statistics — such as "active listings," "days on market," and "months supply of inventory" — differently: what is most meaningful are not specific calculations but the trends they illustrate. Most listing and sales data derives from the local or regional multi-listing service (MLS) of the area specified in the analysis, but not all listings or sales are reported to MLS and these won't be reflected in the data. "Homes" signifies real-property, single-household housing units: houses, condos, co-ops, townhouses, duets and TICs (but not mobile homes), as applicable to each market. City/town names refer specifically to the named cities and towns, unless otherwise delineated. Multi-county metro areas will be specified as such. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers to be considered approximate.

Many aspects of value cannot be adequately reflected in median and average statistics: curb appeal, age, condition, amenities, views, lot size, quality of outdoor space, "bonus" rooms, additional parking, quality of location within the neighborhood, and so on. How any of these statistics apply to any particular home is unknown without a specific comparative market analysis. Median Sales Price is that price at which half the properties sold for more and half for less. It may be affected by seasonality, "unusual" events, or changes in inventory and buying trends, as well as by changes in fair market value. The median sales price for an area will often conceal an enormous variety of sales prices in the underlying individual sales.

Dollar per Square Foot is based upon the home's interior living space and does not include garages, unfinished attics and basements, rooms built without permit, patios, decks or yards (though all those can add value to a home). These figures are usually derived from appraisals or tax records, but are sometimes unreliable (especially for older homes) or unreported altogether. The calculation can only be made on those home sales that reported square footage.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.