February 2023 Market Report

Photo by Bernadette Gatsby on Unsplash

All too often, we see buyers wringing their hands, wondering when the right time to buy will be. The simple answer is that the right time is when you’re ready. Multiple variables act as levers to manipulate the market. When rates go up or financial markets go down, buyer demand decreases, and prices follow suit. When rates decline or markets go up, the opposite happens. So, if you’re waiting for a moment when mortgage rates are low, financial markets are high, and housing prices are dropping, it’s just not ever likely to happen. It would take a massive glut of housing inventory, which we do not have in San Francisco.

Because the market has been volatile of late, you can actually see these dynamics at work in the charts below. Over the last year we have seen each of these variables go up and down, and witnessed their impacts on the housing market. Currently we are back to a place where mortgage rates are declining and financial markets are on the upswing; as a consequence, buyer demand is blossoming, as is typical entering the spring season. Prices are still comparatively soft, but that may change, and soon.

So if you’re waiting for just the right moment to jump in the market, consider that could be happening right now — or whenever you’re ready.

Early 2023 Data Suggests Buyers Are Beginning to Jump Back In

December is typically the month that sees the year’s lowest level of deal-making activity – i.e. listings accepting offers (going into contract) – which leads to January usually posting the lowest monthly number of closed sales. (Sales typically close 3 to 6 weeks after going into contract.) In the 11-county, greater Bay Area, accepted-offer activity in December 2022 and closed sales volume in January 2023 generally hit their lowest monthly points in 14 to 15 years. (SF hit lower points in listings going into contract in January 2019 and, after the pandemic hit, in April 2020.)

Typically, after the long holiday slowdown, the market just begins to wake up in mid-January before accelerating into spring. That being said, inflation has dropped substantially since June and interest rates since November, home prices are well down from last spring, stock markets are up 8% (S&P) to 15% (Nasdaq) YTD as of 2/3/23 (albeit with continuing volatility), and despite escalating layoffs in high tech, early indications in 2023 point to rebounding buyer demand. Open house traffic has jumped, more buyers are requesting listing disclosure packages, and there have been increasing reports of multiple offers and (often unexpected) overbidding of asking price. Based on this preliminary data (much of it still anecdotal*), it appears that buyer demand severely repressed by economic conditions in the 2nd half of 2022 has begun to bounce back.

A similar rebound began in mid-late summer 2022 for similar reasons – a significant drop in mortgage rates and a large rise in stock markets – which then quickly faded when positive economic developments went into reverse. Market activity then slowed further through the rest of 2022. There are currently considerable hopes for a more lasting economic recovery in 2023.

During the long high-tech and pandemic housing boom – which peaked in April/May 2022 – as each new year began, the classic dynamic was for buyers to jump back into the market much more quickly than sellers, creating an immediate imbalance between supply and demand. Too few new listings compared to the quantity of motivated buyers sparked often ferocious bidding wars, leading to considerable home price gains virtually every spring. It is too early to conclude, after the general price declines and steep drops in market activity seen in the 2nd half of 2022, that a sustained recovery in market conditions is now underway, and if it is, how quickly it will develop and its impact on prices in 2023. Many economic conditions remain challenging – with critical indicators still much weaker on a year-over-year basis – and forecasts by economists and analysts vary widely. Hopefully, economic conditions will continue to improve, providing the foundation for the recovery in real estate. In the meantime, preliminary indicators are surprisingly positive, and the CEO of Compass recently stated his belief that Q4 2022 saw the bottom of the market.

The “spring market,” which can begin as early as February in the Bay Area, is typically the biggest selling season of the year, especially for luxury homes, and more data regarding new listings coming on market, listings going into contract, sales volumes, speed of sale, overbidding and sales prices will soon become available.*

* Most “hard” data in real estate is based on closed, recorded sales, a lagging indicator which generally reflects deal-making activity in the previous month, when offers were negotiated. January sales, the basis for many analyses in this report, mostly reflect the December 2022 market when new listing activity and buyer demand were typically at their lowest ebb in years. February and March listing and sales data will begin to better reflect early 2023 conditions.

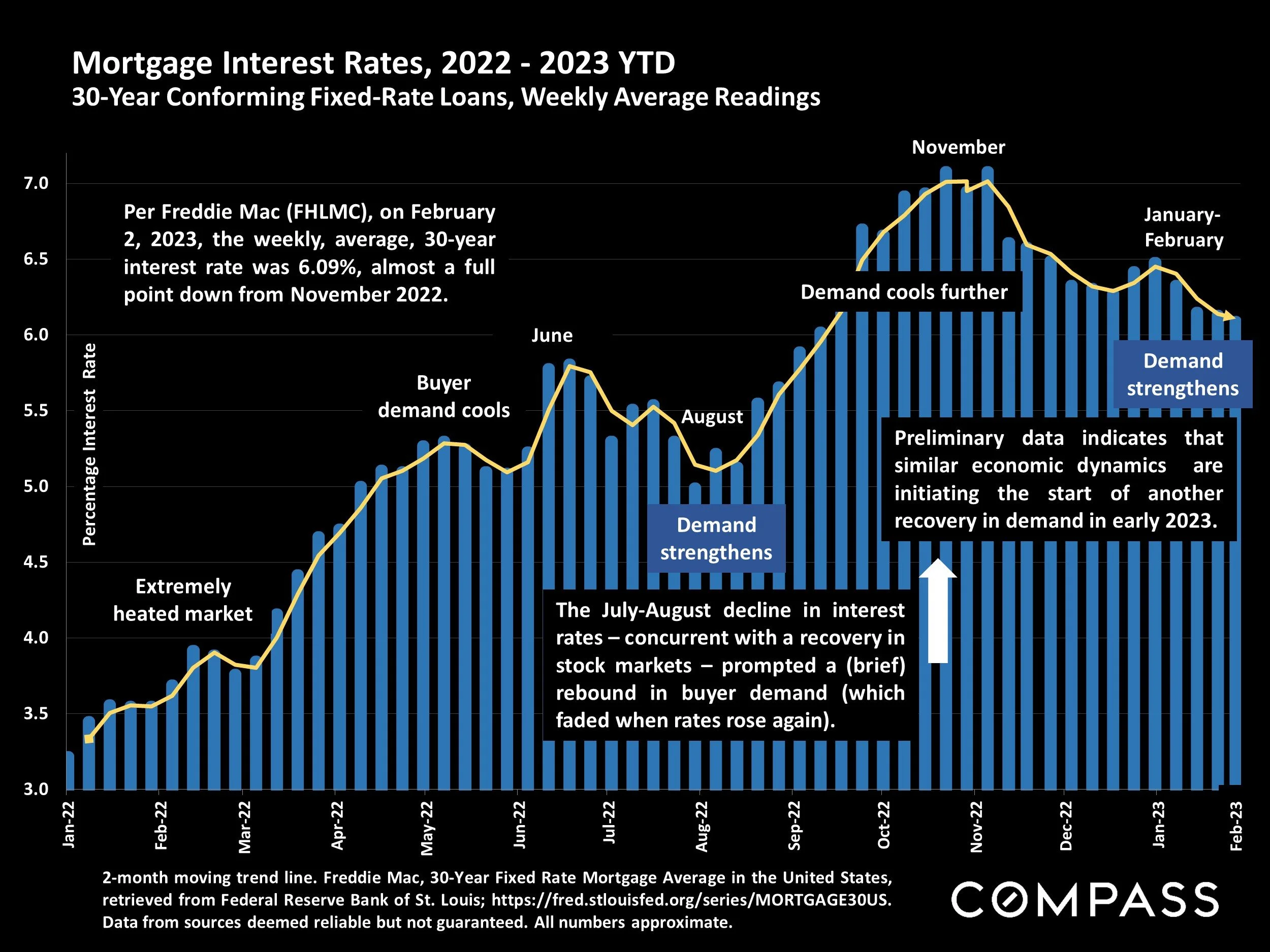

Mortgage Interest Rates, 2022 - 2023 YTD

30-Year Conforming Fixed-Rate Loans, Weekly Average Readings

2-month moving trend line. Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States, retrieved from Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US. Data from sources deemed reliable but not guaranteed. All numbers approximate.

Per Freddie Mac (FHLMC), on February 2, 2023, the weekly, average, 30-year interest rate was 6.09%, almost a full point down from November 2022.

The July-August decline in interest rates — concurrent with a recovery in stock markets — prompted a (brief) rebound in buyer demand (which faded when rates rose again). Preliminary data indicates that similar economic dynamics are initiating the start of another recover in demand in early 2023.

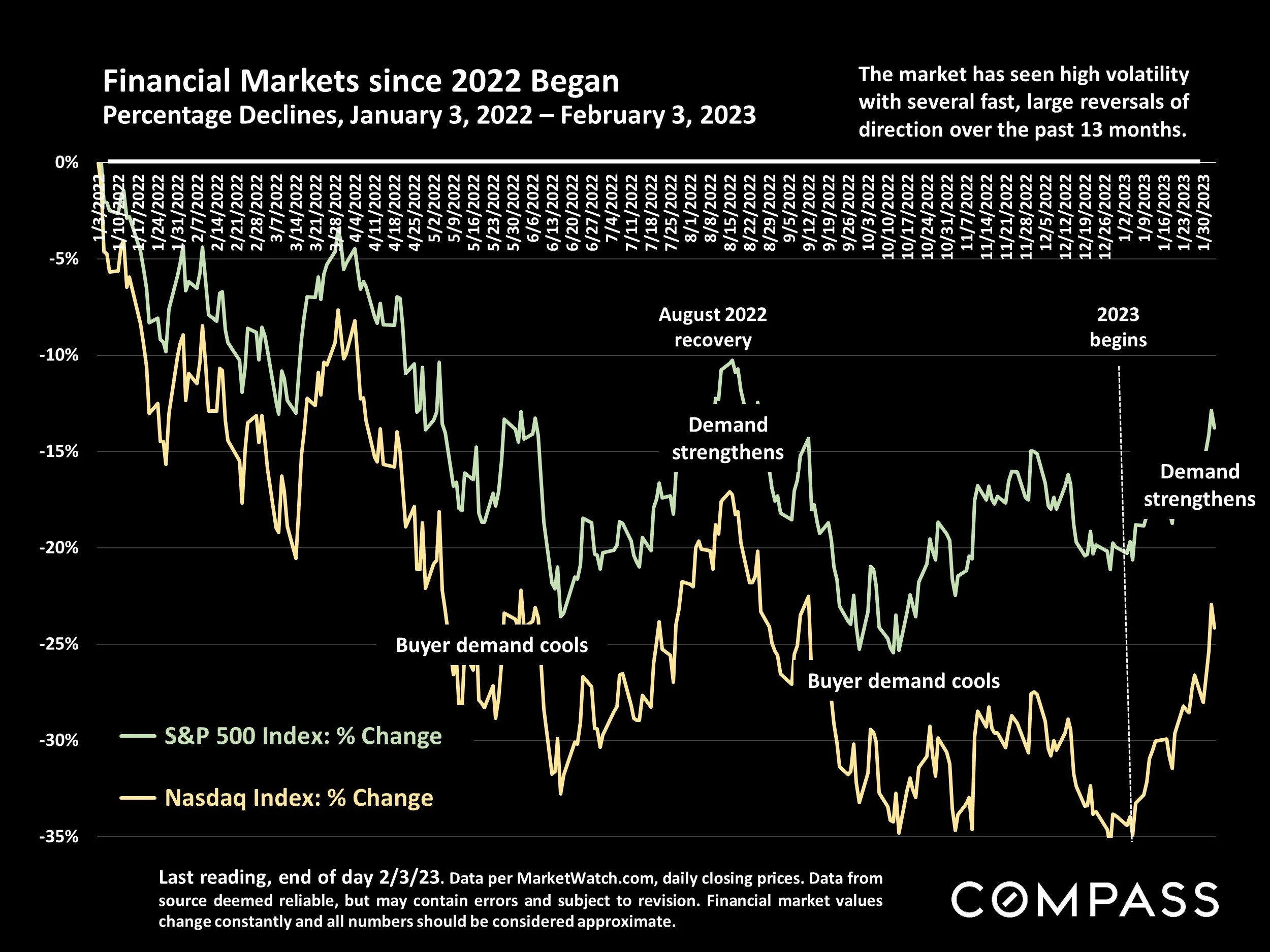

Financial Markets since 2022 Began

Percentage Declines, January 3, 2022 – February 3, 2023

Last reading, end of day 2/3/23. Data per MarketWatch.com, daily closing prices. Data from source deemed reliable, but may contain errors and subject to revision. Financial market values change constantly and all numbers should be considered approximate.

The market has seen high volatility with several fast, large reversals of direction over the past 13 months. But predictably, when markets recover. so too does buyer demand.

San Francisco House Price Trends since 1990

Monthly Median House Sales Prices, 3-Month Rolling Average

3-month rolling average of monthly median sales prices for “existing” houses, per CA Association of Realtors or NorCal MLS Alliance. 2-period moving trend line. Analysis may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

Median sales price is that price at which half the sales occurred for more and half for less. It is a very general statistic, disguising an enormous range of sales prices in the underlying sales. It is often affected by other factors besides changes in fair market value. Monthly and seasonal fluctuations are common, which explain many of the regular ups and downs in this chart. Longer-term trends are much more meaningful than short-term changes.

Year over year, the 3-month rolling, median house sales price in January 2023, $1,500,000, was down about 16.5%.

San Francisco House Prices

Median HOUSE Sales Prices by Bedroom Count*

Early 2023 Update Selected District Markets

| Realtor District Markets | 2BR House | 3BR House | 4BR House | 5+BR House |

|---|---|---|---|---|

| Richmond District, Lone Mountain (District 1 South) | $1,300,000 | $1,650,000 | $2,300,000 | $2,125,000 |

| Sea Cliff, Lake Street, Jordan Park (District 1 North) | $2,700,000 | $4,200,000 | $4,450,000 | |

| Sunset, Parkside, GG Heights (District 2) | $1,360,000 | $1,505,500 | $1,712,500 | $1,800,000 |

| Lakeside, Lakeshore, Ingleside, Oceanview (District 3) | $1,070,000 | $1,450,000 | $1,675,000 | $2,200,000 |

| St. Francis Wood, Forest Hill, West Portal (Dist. 4 West) | $2,087,500 | $2,562,500 | $3,500,000 | |

| Miraloma Park, Midtown Terrace, Sunnyside (Dist. 4 East) | $1,245,000 | $1,665,000 | $1,800,000 | $2,200,000 |

| Noe, Eureka & Cole Valleys; Ashbury Heights (District 5) | $1,610,000 | 2,276,500 | $3,487,500 | $3,270,000 |

| Lower Pacific Heights, Alamo Square, Hayes Valley (District 6) | $3,000,000 | $3,749,500 | ||

| Pacific/Presidio Heights, Cow Hollow, Marina (District 7) | $3,300,000 | $4,635,000 | $8,150,000 | |

| Potrero Hill, Bernal Heights, Inner Mission (District 9) | $1,300,000 | $1,805,000 | $1,787,500 | $2,752,500 |

| Bayview, Excelsior, Portola, Visitacion Valley (District 10) | $1,000,000 | $1,100,000 | $1,245,000 | $1,136,000 |

Median sales price is that price at which half the sales occurred for more and half for less: It is a very general statistic, affected by numerous factors. District areas often include other adjacent neighborhoods. Neighborhoods within areas delineated often have varying values and characteristics. Some areas had very few sales within the segments delineated.

* Sales reported to NorCal MLS Alliance in the 6 months through mid-late 01/23. Data from sources deemed reliable, but may contain errors and subject to revision. How these prices apply to any particular home is unknown without a specific comparative market analysis. All numbers approximate.

San Francisco House Price Trends – by Bedroom Count

Median House Sales Prices, by Quarter, Q1 2018 – Q4 2022

Sales reported to NorCal MLS Alliance, per Infosparks. Data from sources deemed reliable, but may contain errors and subject to revision. Percentages rounded. All numbers are approximate, and may change with late reported sales. Quarterly sales volumes can fluctuate, affecting median sales price calculations.

Median sales price is that price at which half the sales occurred for more and half for less, and it typically disguises a huge variety of prices in the individual underlying sales. It is a very general statistic often affected by factors other than changes in fair market value. Quarterly and seasonal fluctuations are common, and it’s not unusual for median prices to peak for the calendar year in Q2.

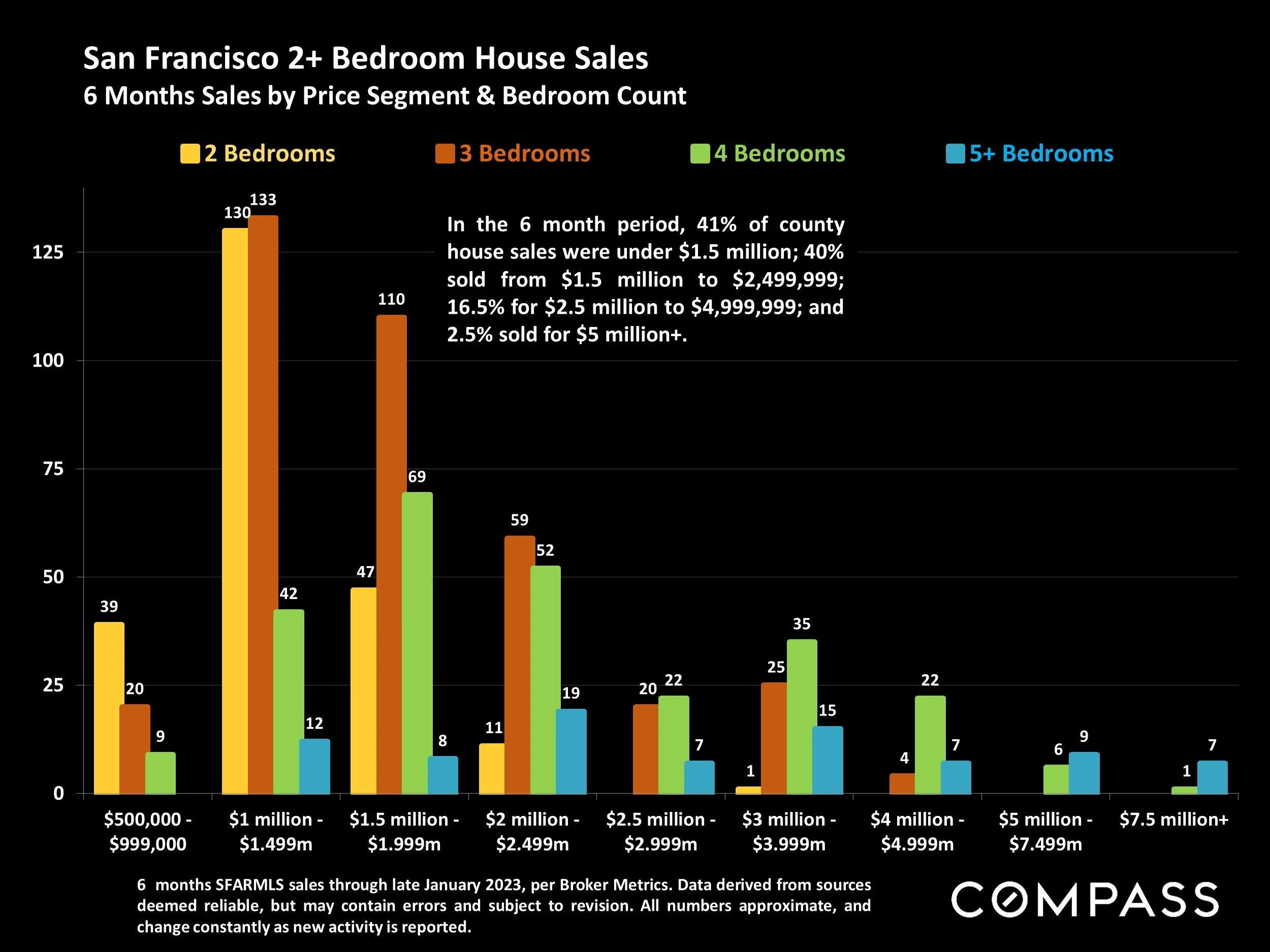

San Francisco 2+ Bedroom House Sales

6 Months Sales by Price Segment & Bedroom Count

6 months SFARMLS sales through late January 2023, per Broker Metrics. Data derived from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and change constantly as new activity is reported.

In the 6 month period, 41% of county house sales were under $1.5 million; 40%sold from $1.5 million to $2,499,999; 16.5% for $2.5 million to $4,999,999; and 2.5% sold for $5 million+.

San Francisco Luxury HOUSE Market

House Sales of $4,000,000+, by District, 12 Months Sales*

* 12 months sales reported to NorCal MLS Alliance through late January 2023 (plus a few media-reported sales). Not all luxury home sales are reported to MLS. Neighborhood groupings correspond to SF Realtor districts, which often include adjacent neighborhoods not listed. Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate.

67% of SF luxury house sales occurred in the first 5 months of the 12-month period, with a significant decline in sales volume beginning in mid-2022. There were 13 house sales of $10 million+ reported during the period, with 11 of them in the Pacific & Presidio Heights, Cow Hollow District (District 7). Other districts had fewer sales in these price segments.

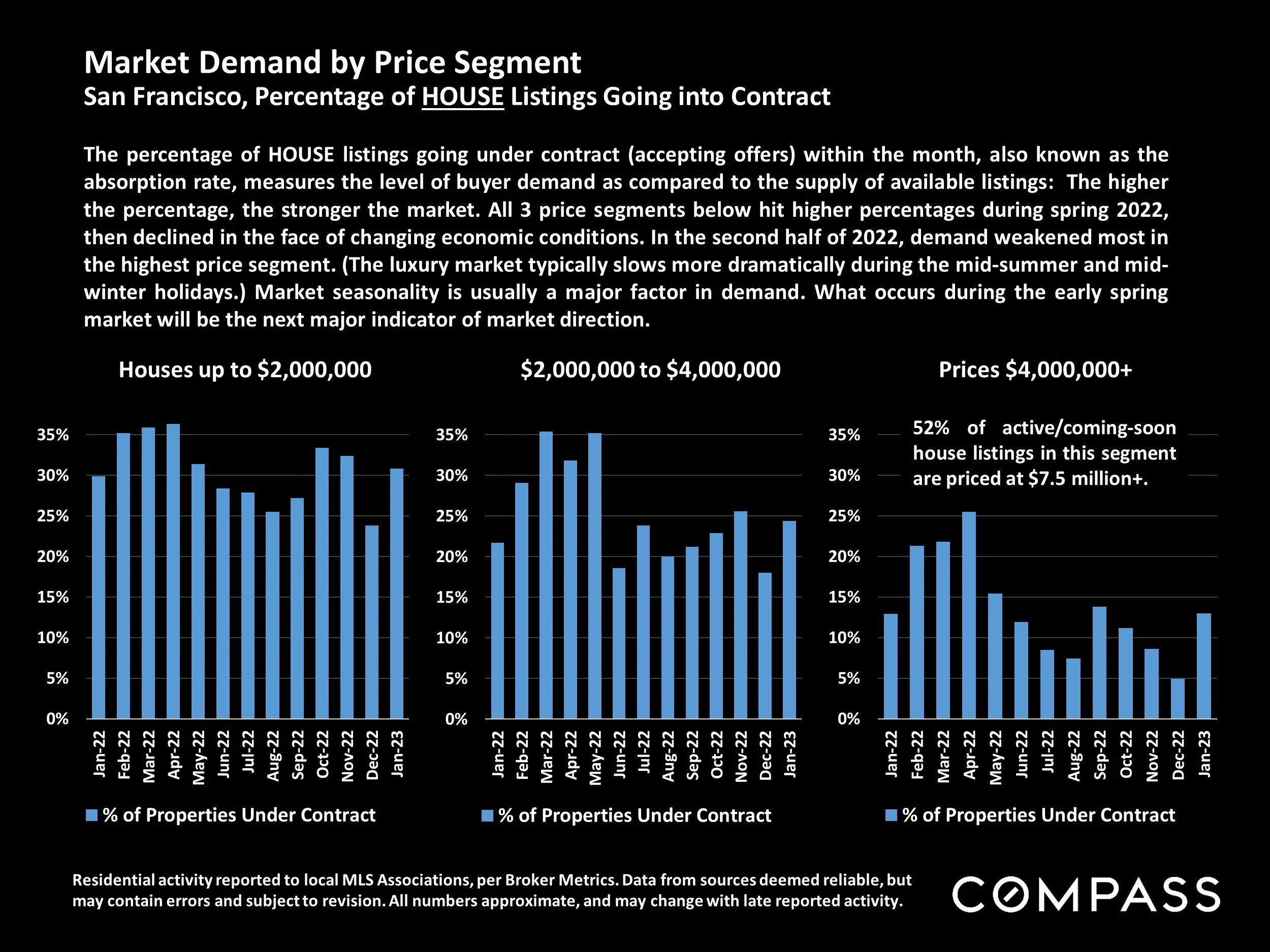

Market Demand by Price Segment

San Francisco, Percentage of HOUSE Listings Going into Contract

Residential activity reported to local MLS Associations, per Broker Metrics. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and may change with late reported activity.

The percentage of HOUSE listings going under contract (accepting offers) within the month, also known as the absorption rate, measures the level of buyer demand as compared to the supply of available listings: The higher the percentage, the stronger the market. All 3 price segments below hit higher percentages during spring 2022, then declined in the face of changing economic conditions. In the second half of 2022, demand weakened most in the highest price segment. (The luxury market typically slows more dramatically during the mid-summer and mid-winter holidays.) Market seasonality is usually a major factor in demand. What occurs during the early spring market will be the next major indicator of market direction.

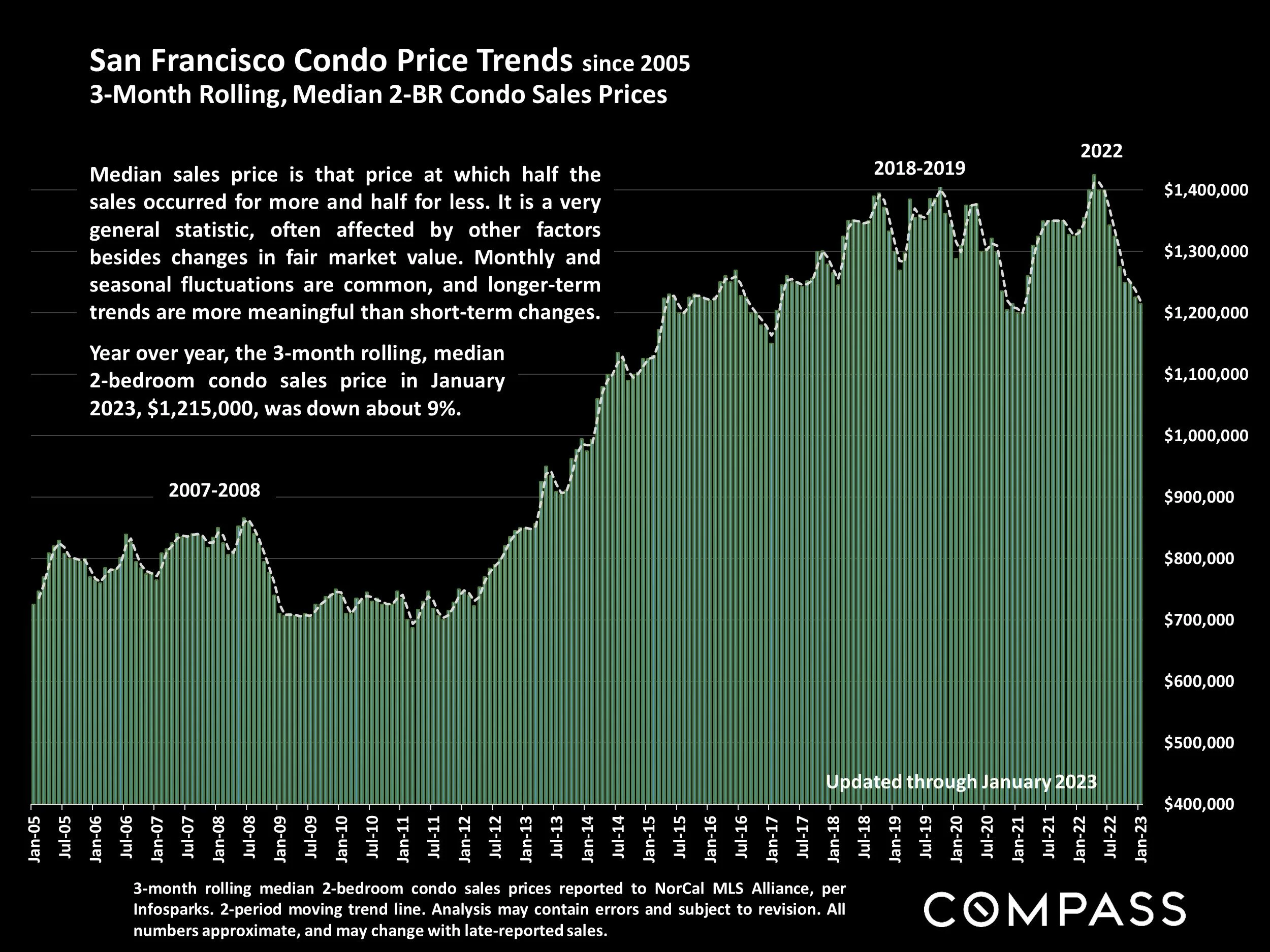

San Francisco Condo Price Trends since 2005

3-Month Rolling, Median 2-BR Condo Sales Prices

3-month rolling median 2-bedroom condo sales prices reported to NorCal MLS Alliance, per Infosparks. 2-period moving trend line. Analysis may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

Median sales price is that price at which half the sales occurred for more and half for less. It is a very general statistic, often affected by other factors besides changes in fair market value. Monthly and seasonal fluctuations are common, and longer-term trends are more meaningful than short-term changes.

Year over year, the 3-month rolling, median 2-bedroom condo sales price in January 2023, $1,215,000, was down about 9%.

San Francisco Condo Prices

Median CONDO Sales Prices by Bedroom Count*

| Realtor District Markets | 1BR Condo | 2BR Condo | 3+BR Condo | |

|---|---|---|---|---|

| Hunter’s & Candlestick Points, Bayview, Crocker Amazon (District 10) | $525,000 | $694,500 | $940,000 | |

| Van Ness/Civic Center, Downtown (District 8 South) | $548,500 | $1,005,000 | ||

| South of Market/SoMa (Mid-District 9) | $675,000 | $950,000 | ||

| Potrero Hill, Bernal Heights, Inner Mission, Dogpatch (District 9 South) | $824,000 | $1,150,000 | $1,390,000 | |

| Lower Pacific Heights, Alamo Square, Hayes Valley, NoPa (District 6) | $727,500 | $1,244,500 | $1,515,000 | |

| Richmond District , Lake Street, Jordan Park/Laurel Heights (District 1) | $845,000 | $1,320,000 | $1,610,000 | |

| Noe, Eureka & Cole Valleys; Ashbury Heights; Mission Dolores (District 5) | $785,000 | $1,375,000 | $1,812,500 | |

| South Beach, Mission Bay, Yerba Buena (District 9 North) | $800,000 | $1,388,000 | $2,900,000 | |

| Russian, Nob & Telegraph Hills; North Beach, Financial Dist. (District 8 North) | $898,000 | $1,280,000 | $1,900,000 | |

| Pacific/Presidio Heights, Cow Hollow, Marina (District 7) | $1,060,000 | $1,575,000 | $2,050,000 |

* Sales reported to NorCal MLS Alliance in the 6 months through mid-late 01/23. Data from sources deemed reliable, but may contain errors and subject to revision. How these prices apply to any particular home is unknown without a specific comparative market analysis. All numbers approximate.

Median sales price is that price at which half the sales occurred for more and half for less: It is a very general statistic, affected by numerous factors beyond bedroom count. District areas often include other adjacent neighborhoods. Neighborhoods within areas delineated often have varying values and characteristics. Some areas had very few sales within the segments delineated. The floor a unit is on – and the views offered – can play an enormous role in condo values, especially in high-rises.

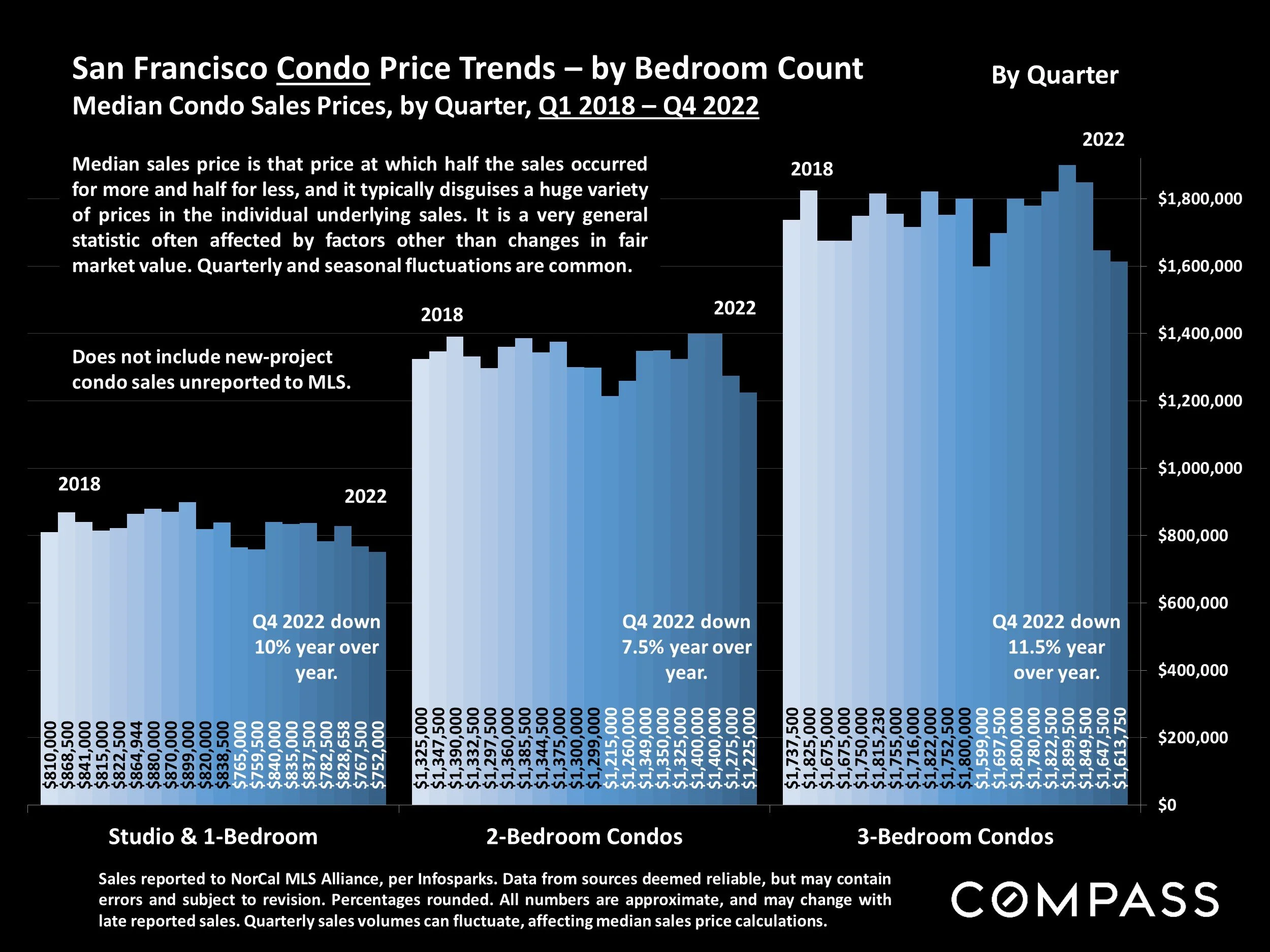

San Francisco Condo Price Trends – by Bedroom Count

Median Condo Sales Prices, by Quarter, Q1 2018 – Q4 2022

Sales reported to NorCal MLS Alliance, per Infosparks. Data from sources deemed reliable, but may contain errors and subject to revision. Percentages rounded. All numbers are approximate, and may change with late reported sales. Quarterly sales volumes can fluctuate, affecting median sales price calculations.

Median sales price is that price at which half the sales occurred for more and half for less, and it typically disguises a huge variety of prices in the individual underlying sales. It is a very general statistic often affected by factors other than changes in fair market value. Quarterly and seasonal fluctuations are common. Does not include new-project condo sales unreported to MLS.

San Francisco 1+ Bedroom Condo, Co-op, Townhouse, TIC Sales

6 Months Sales by Price Segment & Bedroom Count

6 months SFARMLS sales through late January 2023, per Broker Metrics. Does not include new-project condo sales unreported to MLS. Data derived from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and change constantly as new activity is reported.

In the 6 month period, 40% of SF 1-BR+ condo, co-op, townhouse and TIC sales were under $1 million; 50% sold from $1 million to $1,999,999; and 10% sold for $2 million+.

San Francisco Luxury Condo, Co-op & TIC Market

Sales Prices of $2.5 Million+, by District, 12 Months Sales*

* 12 months sales reported to NorCal MLS Alliance through late January 2023. Not all sales are reported to MLS. Neighborhood groupings correspond to SF Realtor districts, which often include adjacent neighborhoods. Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate.

64% of SF luxury condo, co-op & TIC sales occurred in the first 5 months of the 12-month period, with a significant decline in sales volume beginning in mid-2022. 199 of these sales were condos, 18 were co-ops, and 6 TICs. Some new-project luxury condo sales are not reported to MLS. These projects are mostly concentrated in the greater South Beach/Yerba Buena/SoMa area.

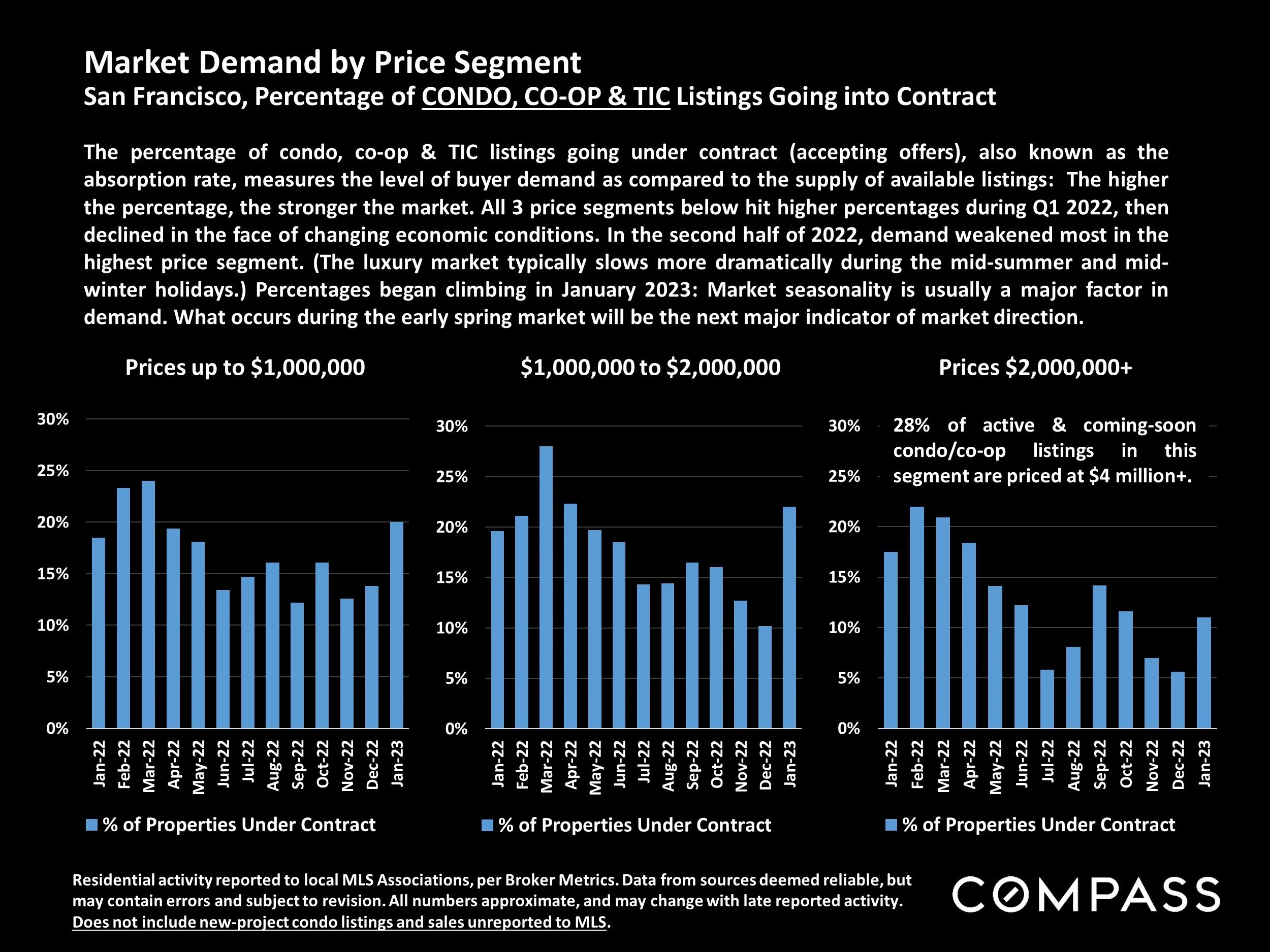

Market Demand by Price Segment

San Francisco, Percentage of CONDO, CO-OP & TIC Listings Going into Contract

Residential activity reported to local MLS Associations, per Broker Metrics. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and may change with late reported activity. Does not include new-project condo listings and sales unreported to MLS.

The percentage of condo, co-op & TIC listings going under contract (accepting offers), also known as the absorption rate, measures the level of buyer demand as compared to the supply of available listings: The higher the percentage, the stronger the market. All 3 price segments below hit higher percentages during Q1 2022, then declined in the face of changing economic conditions. In the second half of 2022, demand weakened most in the highest price segment. (The luxury market typically slows more dramatically during the mid-summer and mid-winter holidays.) Percentages began climbing in January 2023: Market seasonality is usually a major factor in demand. What occurs during the early spring market will be the next major indicator of market direction.

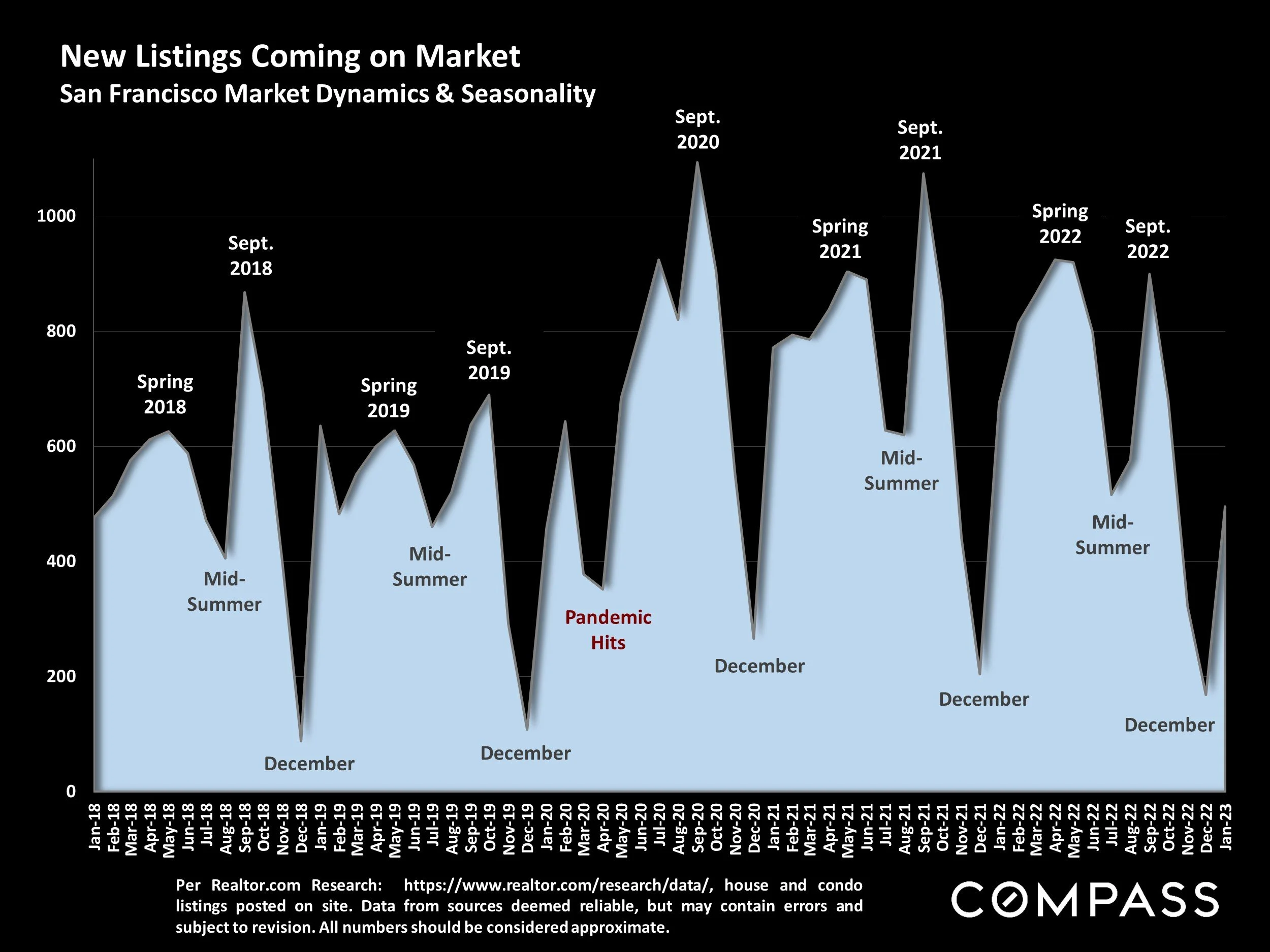

New Listings Coming on Market

San Francisco Market Dynamics & Seasonality

Per Realtor.com Research: https://www.realtor.com/research/data/, house and condo listings posted on site. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers should be considered approximate.

Already, we see the typical trend of an uptick in new listings coming on the market at the start of the year, trending toward the high-volume spring selling season.

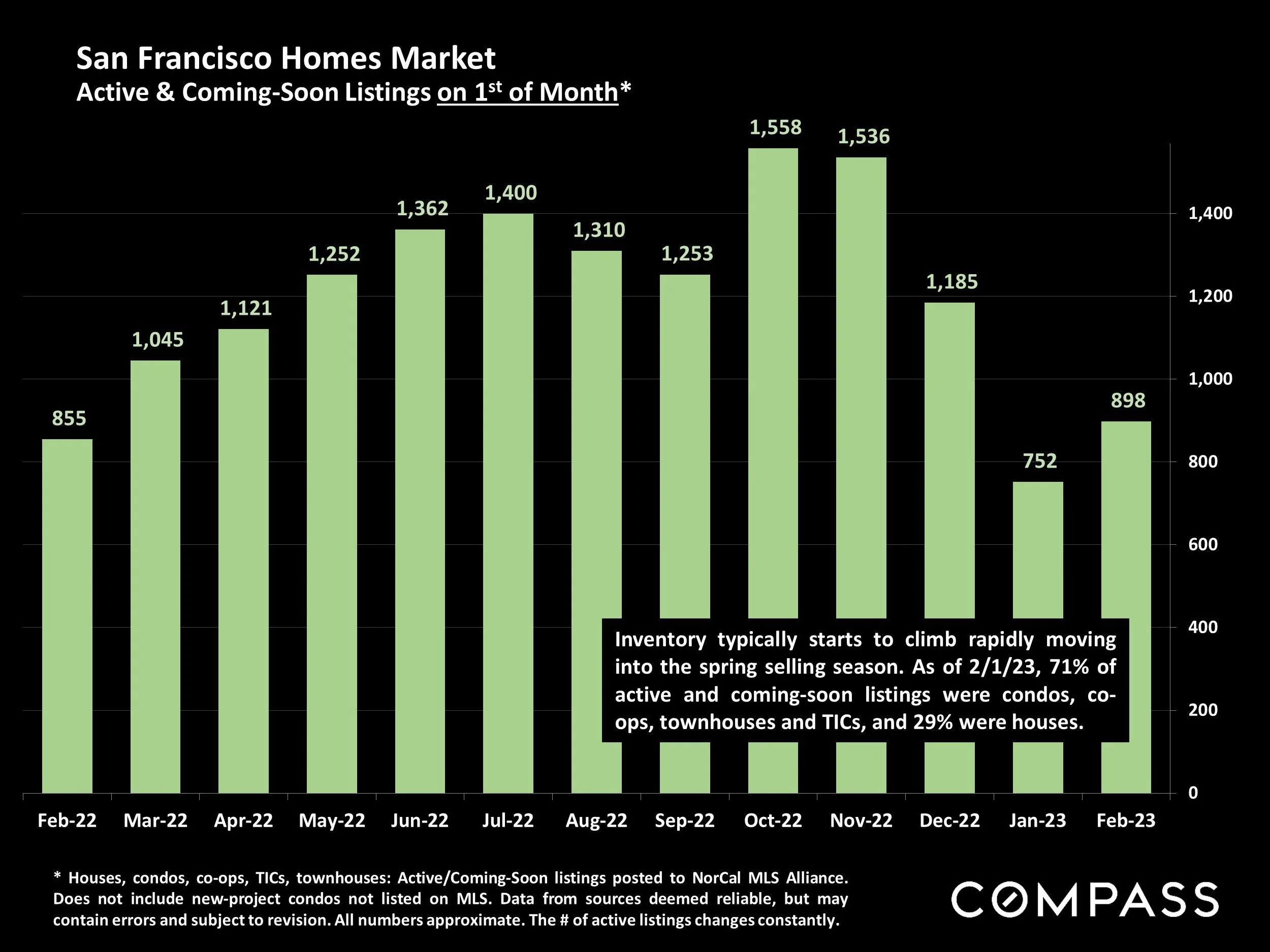

San Francisco Homes Market

Active & Coming-Soon Listings on 1st of Month*

* Houses, condos, co-ops, TICs, townhouses: Active/Coming-Soon listings posted to NorCal MLS Alliance. Does not include new-project condos not listed on MLS. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate. The # of active listings changes constantly.

Inventory typically starts to climb rapidly moving into the spring selling season. As of 2/1/23, 71% of active and coming-soon listings were condos, co-ops, townhouses and TICs, and 29% were houses.

Active Listings on Market – Longer-Term Trends

San Francisco Market Dynamics & Seasonality

Per Realtor.com Research: https://www.realtor.com/research/data/, house and condo listings posted on site. May not include coming-soon listings. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate.

This is a snapshot measure of how many active listings can be expected on any given day of the specified month.

The number of active listings on a given day is affected by 1) how many new listings come on market, 2) how quickly buyers snap them up, 3) the sustained heat of the market over time, and 4) how many sellers pull their homes off the market without selling. The number typically ebbs and flows by season.

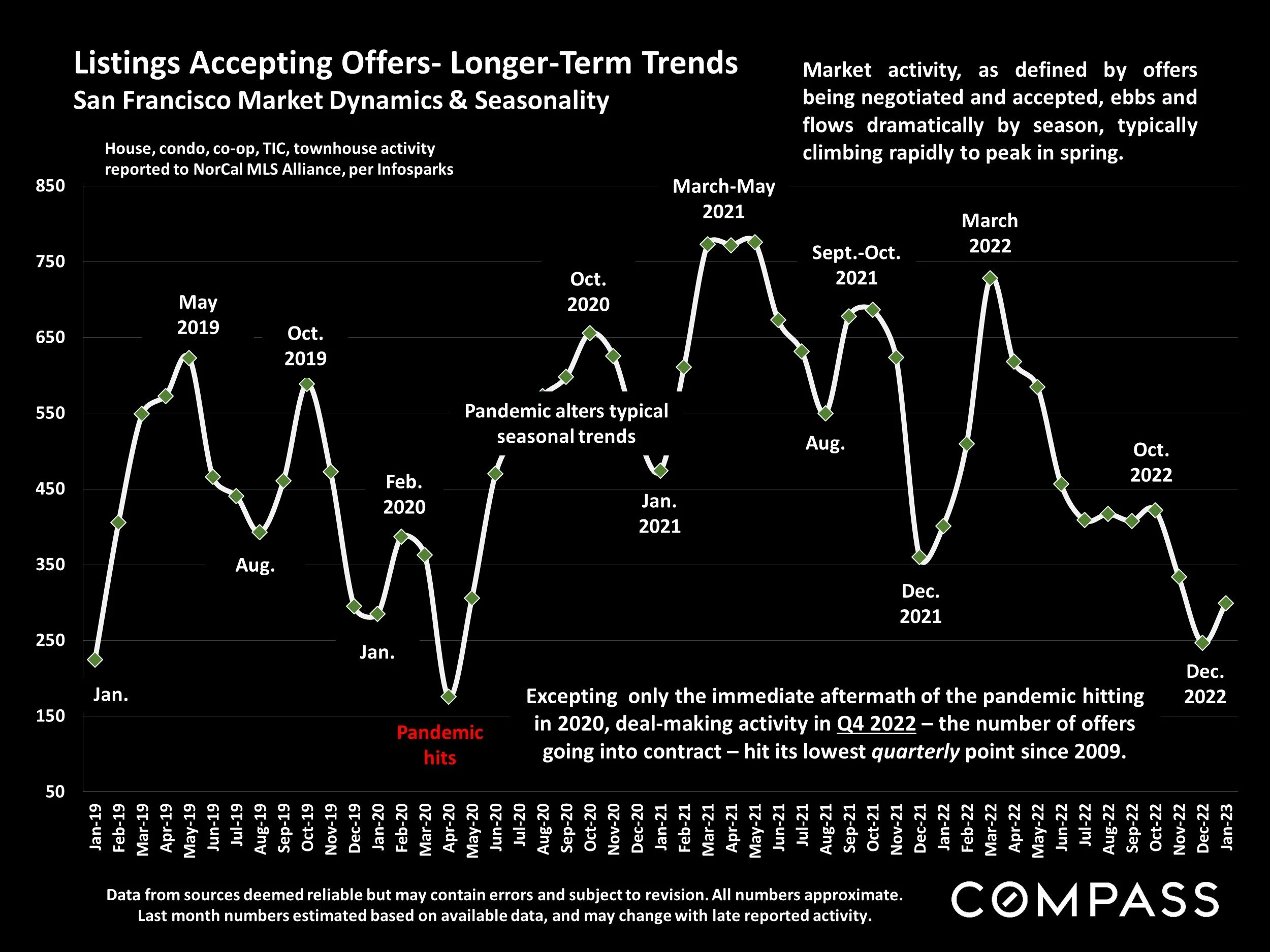

Listings Accepting Offers — Longer-Term Trends

San Francisco Market Dynamics & Seasonality

Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate. Last month numbers estimated based on available data, and may change with late reported activity.

Market activity, as defined by offers being negotiated and accepted, ebbs and flows dramatically by season, typically climbing rapidly to peak in spring.

Excepting only the immediate aftermath of the pandemic hitting in 2020, deal-making activity in Q4 2022 – the number of offers going into contract – hit its lowest quarterly point since 2009.

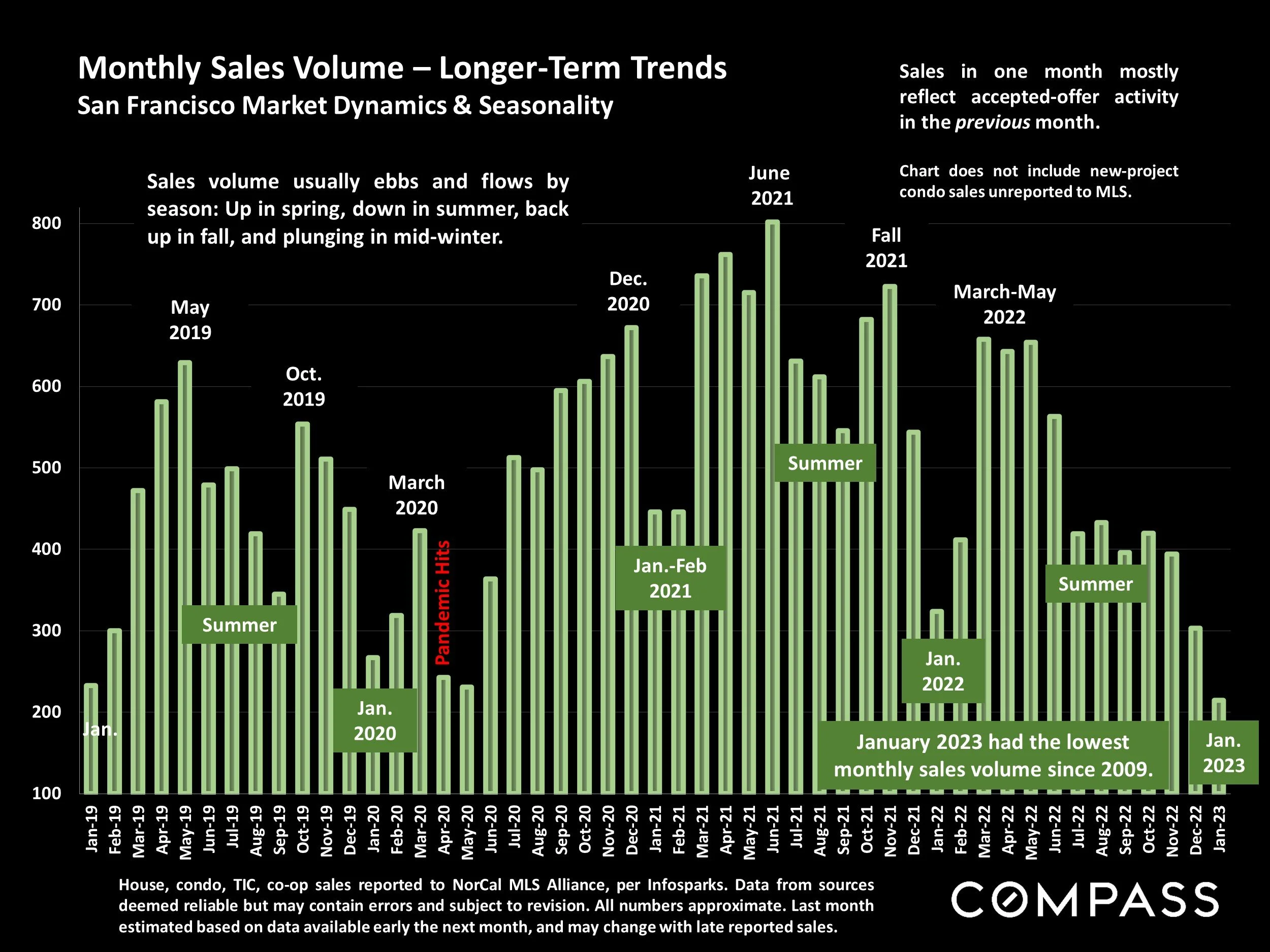

Monthly Sales Volume – Longer-Term Trends

San Francisco Market Dynamics & Seasonality

House, condo, TIC, co-op sales reported to NorCal MLS Alliance, per Infosparks. Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate. Last month estimated based on data available early the next month, and may change with late reported sales.

Sales in one month mostly reflect accepted-offer activity in the previous month. Sales volume usually ebbs and flows by season: Up in spring, down in summer, back up in fall, and plunging in mid-winter.

Chart does not include new-project condo sales unreported to MLS.

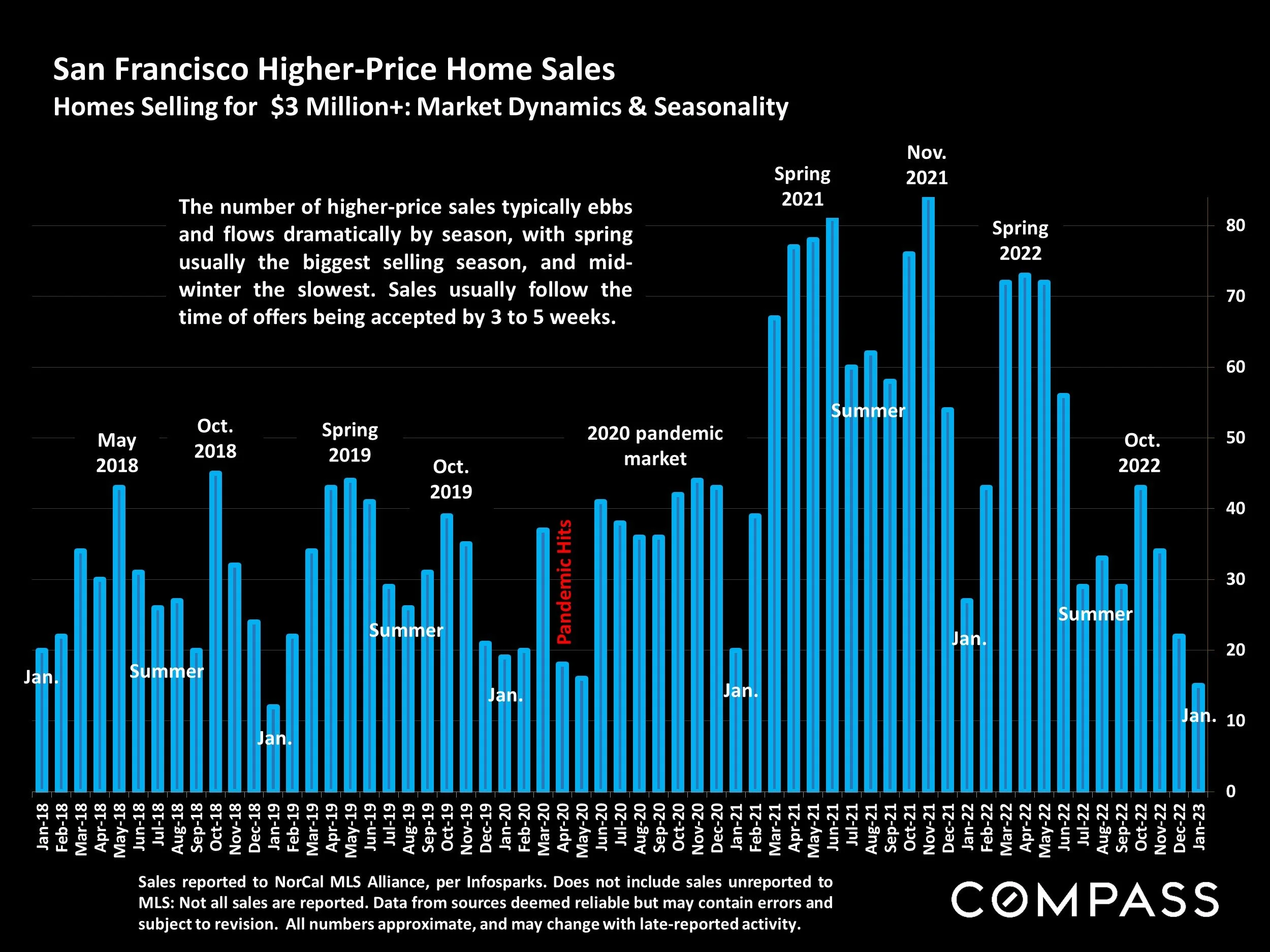

San Francisco Higher-Price Home Sales

Homes Selling for $3 Million+: Market Dynamics & Seasonality

Sales reported to NorCal MLS Alliance, per Infosparks. Does not include sales unreported to MLS: Not all sales are reported. Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate, and may change with late-reported activity.

The number of higher-price sales typically ebbs and flows dramatically by season, with spring usually the biggest selling season, and mid-winter the slowest. Sales usually follow the time of offers being accepted by 3 to 5 weeks.

Ultra-Luxury Home Sales, $5 Million+*

Bay Area Luxury Home Market since January 2021

*Per residential sales reported to NorCal MLS Alliance for 10 Bay Area Counties, Napa to Monterey (excluding Solano), per Infosparks. Data from sources deemed reliable, but may contain errors and subject to revision. Last month estimated from data available early the following month. All numbers approximate, and may change with late-reported sales. Not all luxury sales are reported to MLS.

Year over year, Bay Area January 2023 $5M+ home sales were down about 49%.

Listings Expired or Withdrawn from Market (No Sale)

San Francisco Market Dynamics & Seasonality

House, condo, townhouse activity reported to SFARMLS, per Broker Metrics. Data from sources deemed reliable but may contain errors and subject to revision. All numbers are approximate. Reliable January 2023 data not yet available.

When market conditions abruptly cooled due to economic headwinds, many more listings were pulled off the market without selling in the 2nd half of 2022. It’s not unusual for this number to peak in December for the holiday season slowdown: Typically, many of these homes are put back on the market in the new year, often at lower prices.

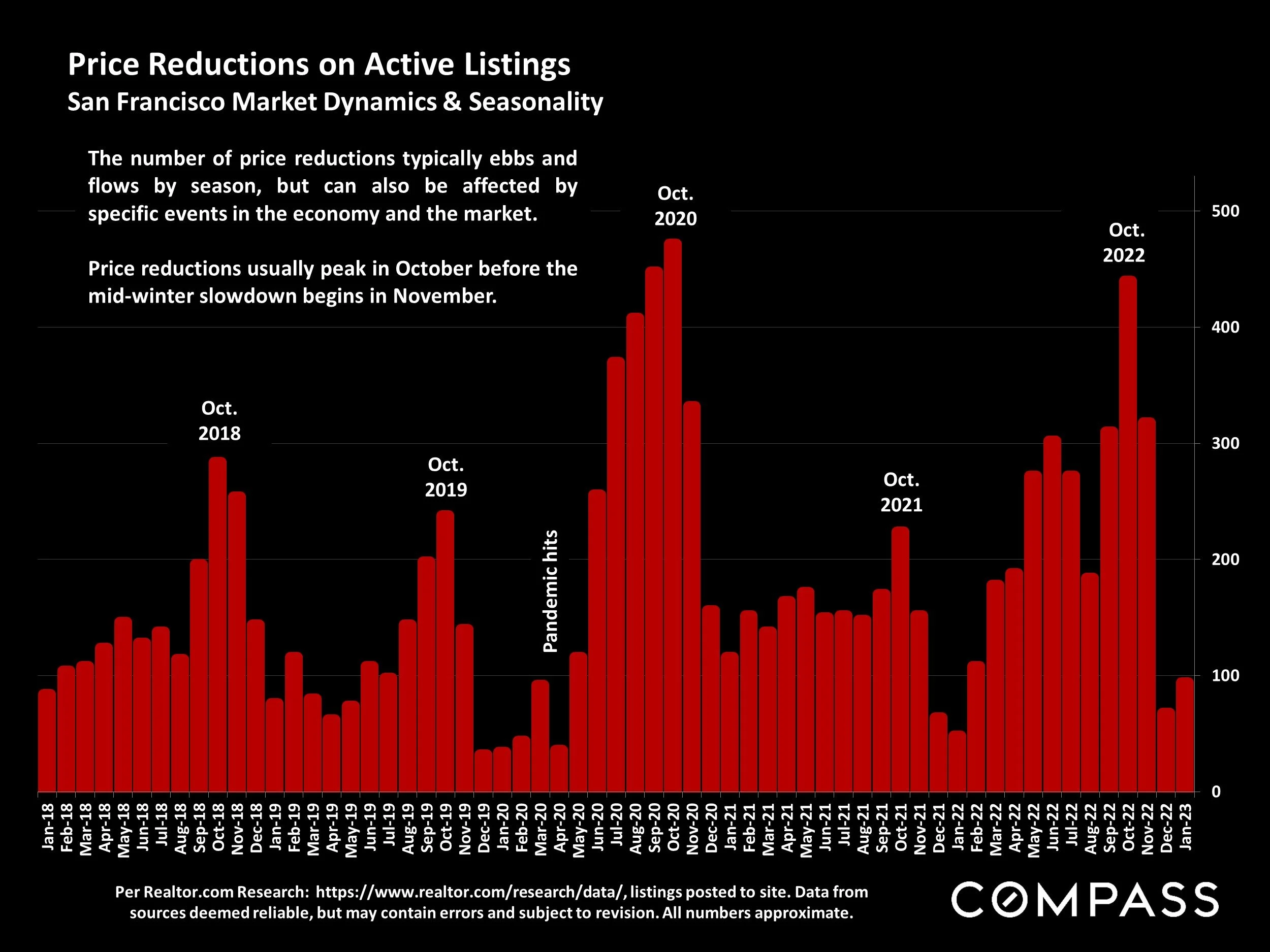

Price Reductions on Active Listings

San Francisco Market Dynamics & Seasonality

Per Realtor.com Research: https://www.realtor.com/research/data/, listings posted to site. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate.

The number of price reductions typically ebbs and flows by season, but can also be affected by specific events in the economy and the market.

Price reductions usually peak in October before the mid-winter slowdown begins in November.

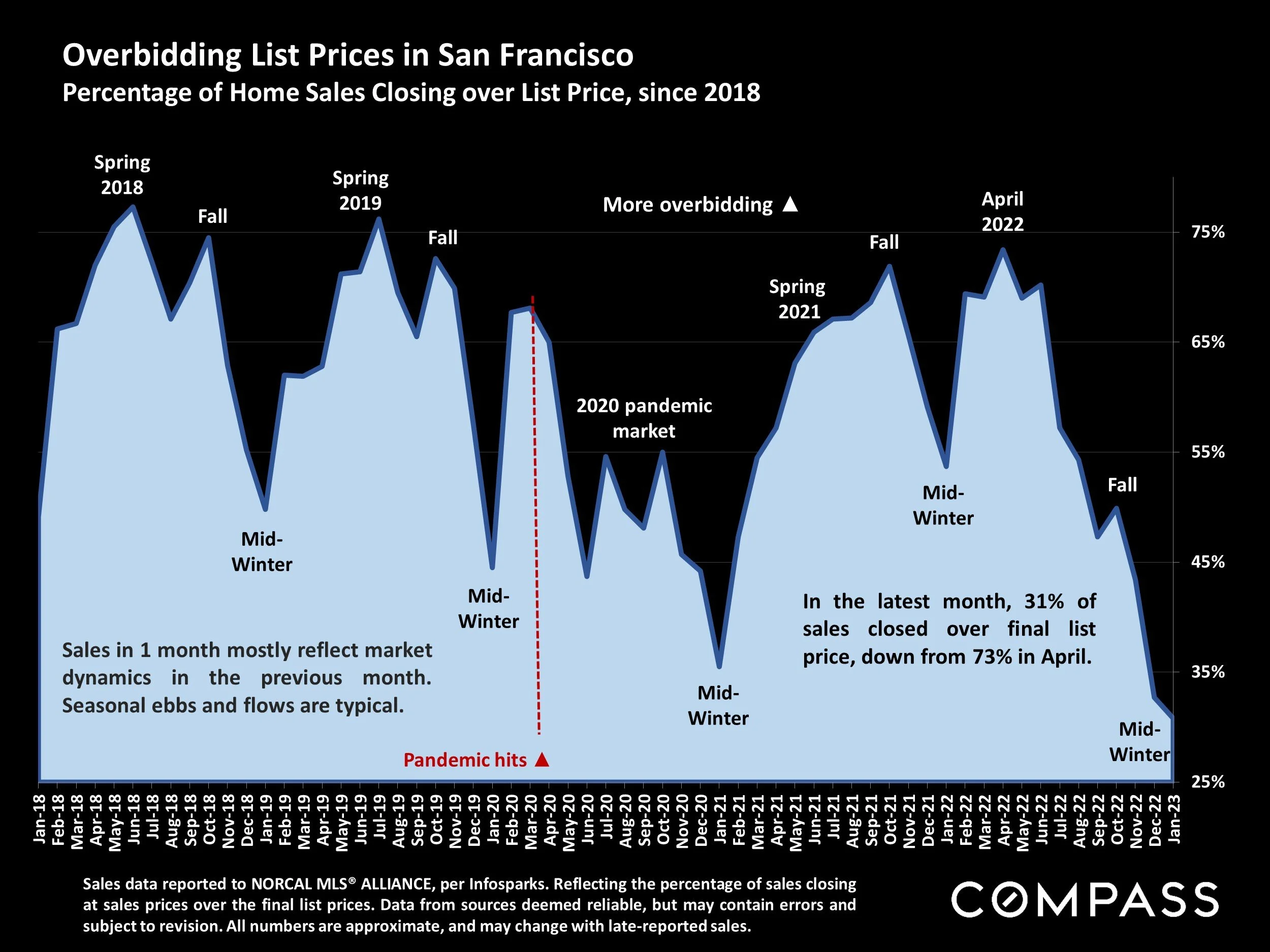

Overbidding List Prices in San Francisco

Percentage of Home Sales Closing over List Price, since 2018

Sales data reported to NORCAL MLS® ALLIANCE, per Infosparks. Reflecting the percentage of sales closing at sales prices over the final list prices. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate, and may change with late-reported sales.

In the latest month, 31% of sales closed over final list price, down from 73% in April.

Sales in 1 month mostly reflect market dynamics in the previous month. Seasonal ebbs and flows are typical.

Average Sales Price to Original List Price Percentage

San Francisco Over/Under Bidding: Market Dynamics & Seasonality

Sales reported to NorCal MLS Alliance, per Infosparks. Data derived from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

Houses have higher average, sales price to list price percentages than condos, but both have plunged since spring 2022. This statistic also fluctuates by season, and is a lagging indicator of market activity 3-6 weeks earlier.

Average Days on Market – Sold Listings

San Francisco Market Dynamics & Seasonality

2-month-period trend lines: Sales reported to NorCal MLS Alliance, per Infosparks. “Condos” include co-op and TIC sales. Data derived from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

Measuring how long it takes for sold listings to accept offers. Houses have much lower average days-on-market readings than condos. Chart illustrates 2-month-moving trend.

This statistic ebbs and flows seasonally, and is a lagging indicator of market activity 3-6 weeks earlier.

Statistics are generalities, essentially summaries of widely disparate data generated by dozens, hundreds or thousands of unique, individual sales occurring within different time periods. They are best seen not as precise measurements, but as broad, comparative indicators, with reasonable margins of error. Anomalous fluctuations in statistics are not uncommon, especially in smaller, expensive market segments. Last period data should be considered estimates that may change with late-reported data. Different analytics programs sometimes define statistics – such as “active listings,” “days on market,” and “months supply of inventory” – differently: what is most meaningful are not specific calculations but the trends they illustrate. Most listing and sales data derives from the local or regional multi-listing service (MLS) of the area specified in the analysis, but not all listings or sales are reported to MLS and these won’t be reflected in the data. “Homes” signifies real-property, single-household housing units: houses, condos, co-ops, townhouses, duets and TICs (but not mobile homes), as applicable to each market. City/town names refer specifically to the named cities and towns, unless otherwise delineated. Multi-county metro areas will be specified as such. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers to be considered approximate.

Many aspects of value cannot be adequately reflected in median and average statistics: curb appeal, age, condition, amenities, views, lot size, quality of outdoor space, “bonus” rooms, additional parking, quality of location within the neighborhood, and so on. How any of these statistics apply to any particular home is unknown without a specific comparative market analysis.

Median Sales Price is that price at which half the properties sold for more and half for less. It may be affected by seasonality, “unusual” events, or changes in inventory and buying trends, as well as by changes in fair market value. The median sales price for an area will often conceal an enormous variety of sales prices in the underlying individual sales.

Dollar per Square Foot is based upon the home’s interior living space and does not include garages, unfinished attics and basements, rooms built without permit, patios, decks or yards (though all those can add value to a home). These figures are usually derived from appraisals or tax records, but are sometimes unreliable (especially for older homes) or unreported altogether. The calculation can only be made on those home sales that reported square footage.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.