January 2021 Market Report

Pandemic, shelter in place, mass unemployment, terrible financial hardships for many households and small businesses, new ways of working, office buildings empty, people move, rents plunge, dreadful fires, an anxious presidential election, interest rates to historic lows, stock markets to new highs, billionaires decamp to save on taxes, IPO mania breaks out again, vaccines begin to arrive – and the real estate market in San Francisco saw complicated dynamics in supply and demand, with a strong recovery after an initial crash in activity.

2020: a year of extremes.

The following review contains a wide variety of analyses designed to be self-explanatory, but please don't hesitate to contact me with any questions.

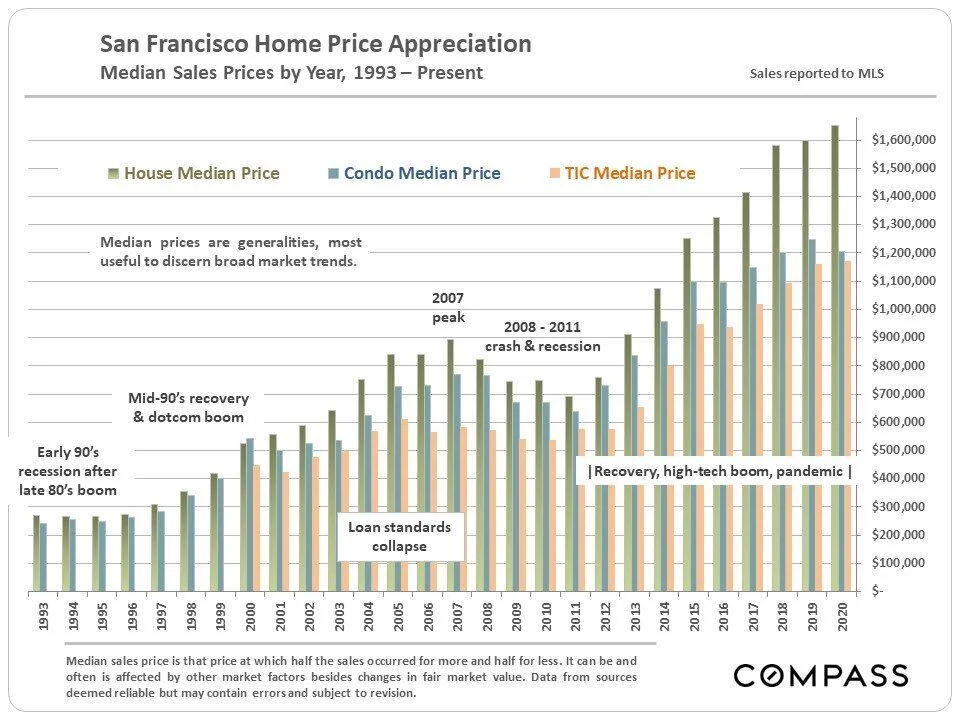

San Francisco Home Price Appreciation, 1993-Present

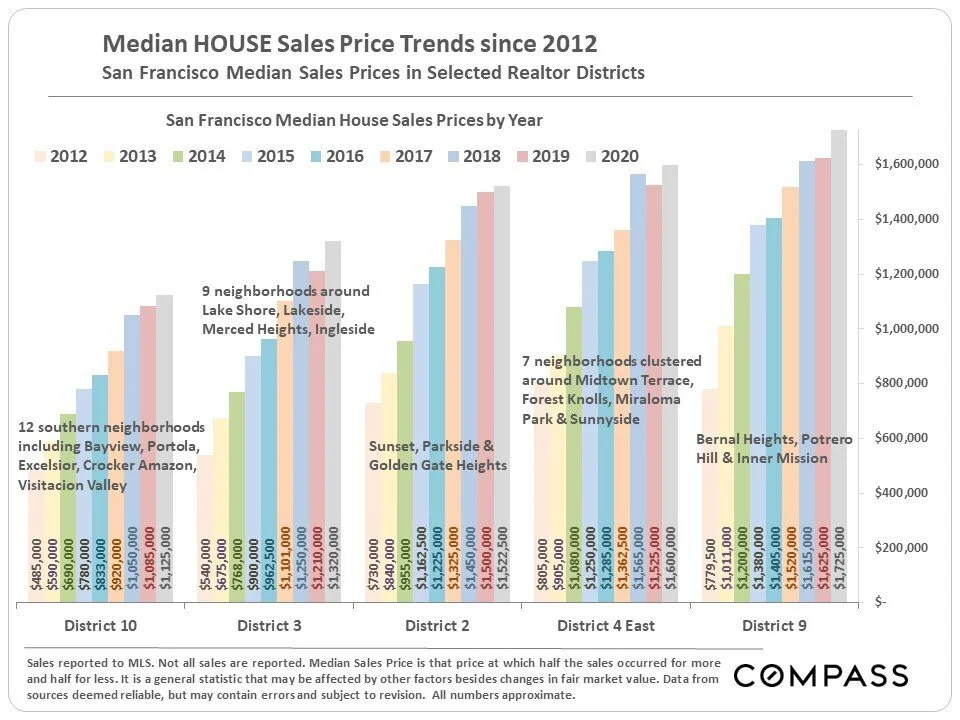

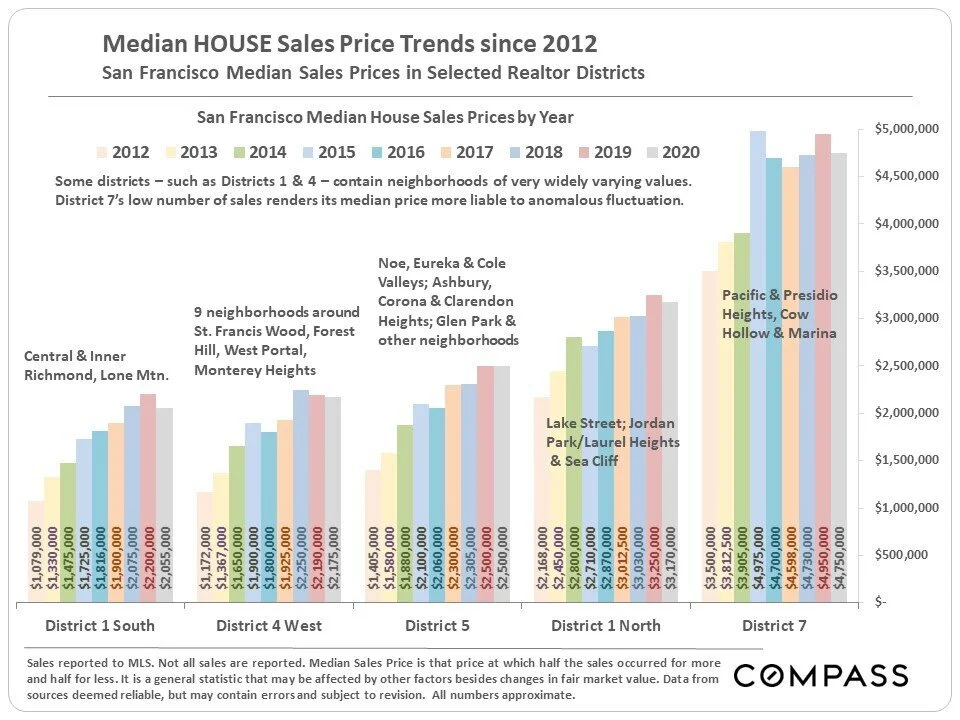

SFR prices continue to escalate and outpace pricing on condos and TICs. This trend is likely to continue into 2021.

San Francisco Real Estate, 2016-2020, Select Market Indicators

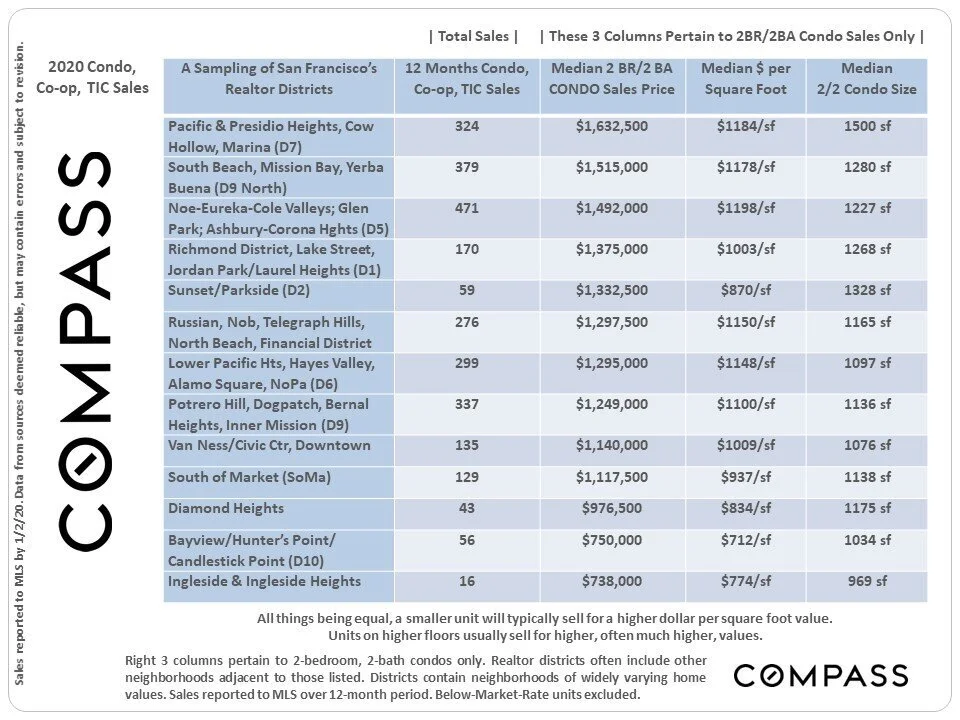

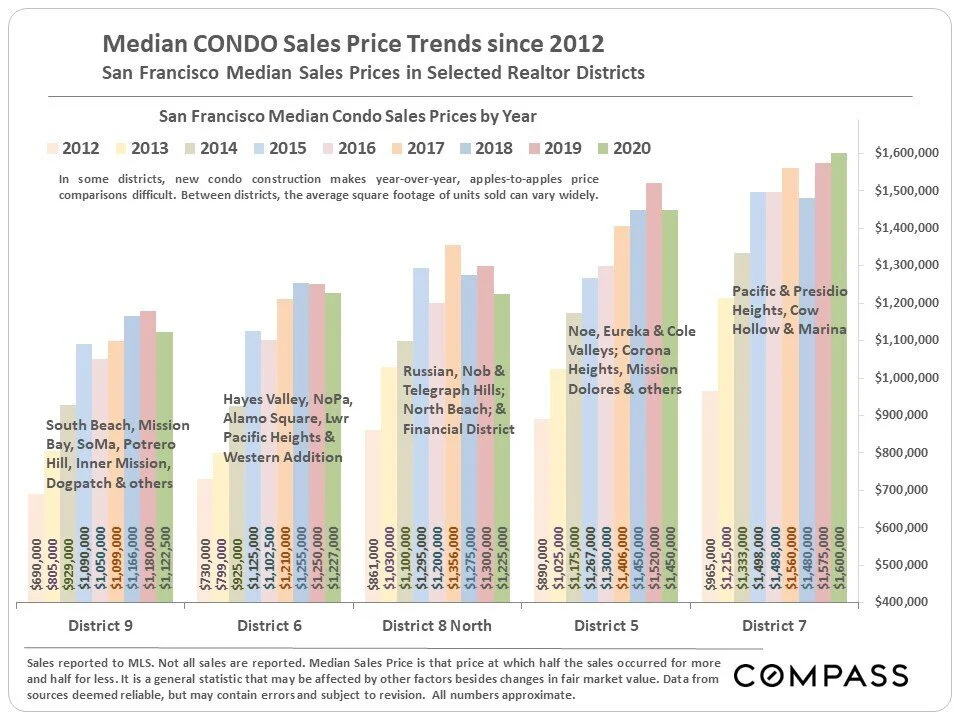

2020 saw significant challenges to the condo market, with a glut of inventory, resulting in more days on market and relatively flat pricing.

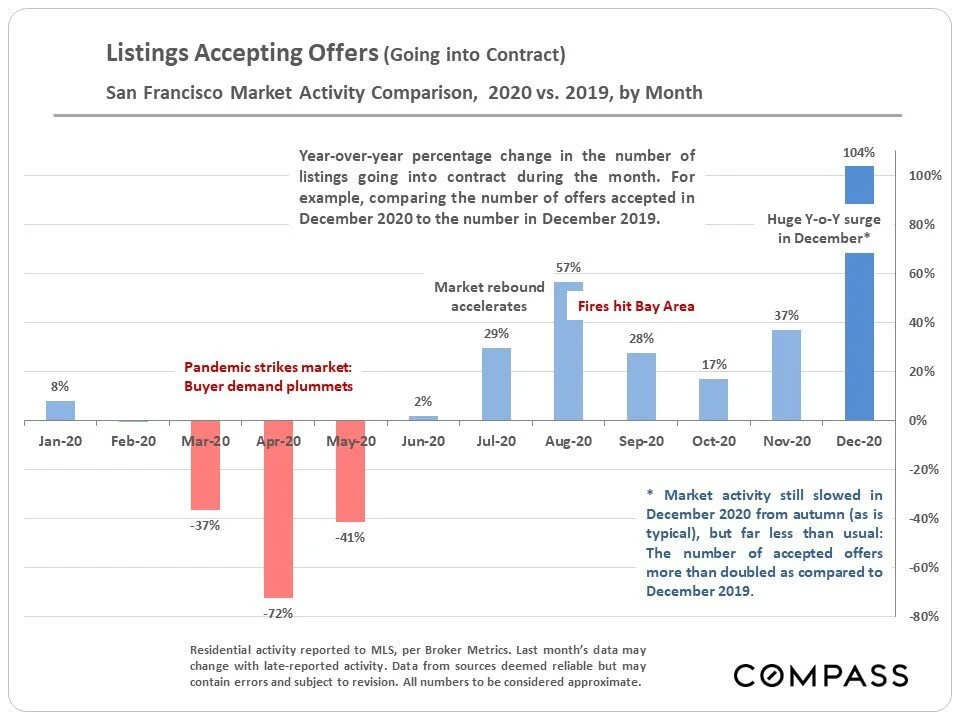

San Francisco Listings Accepting Offers in 2020

Year-over-year percentage change in the number of listings going into contract during the month. During the first three months of the pandemic, sales plummeted as people were locked down and homes could not be shown. Market activity did slow in December from autumn, as usual, but far less than usual.

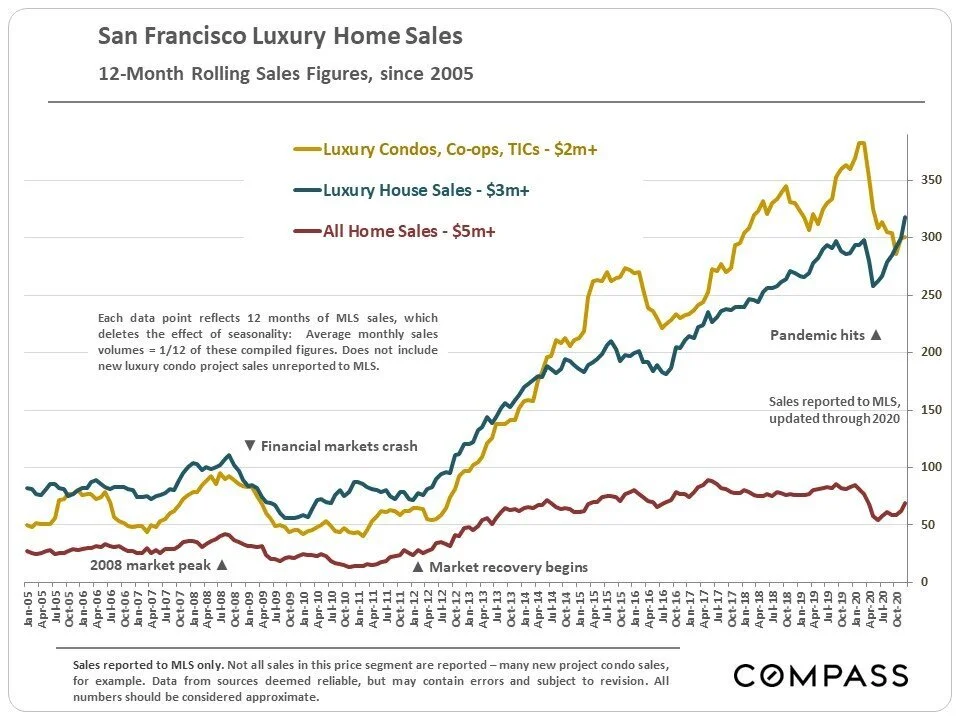

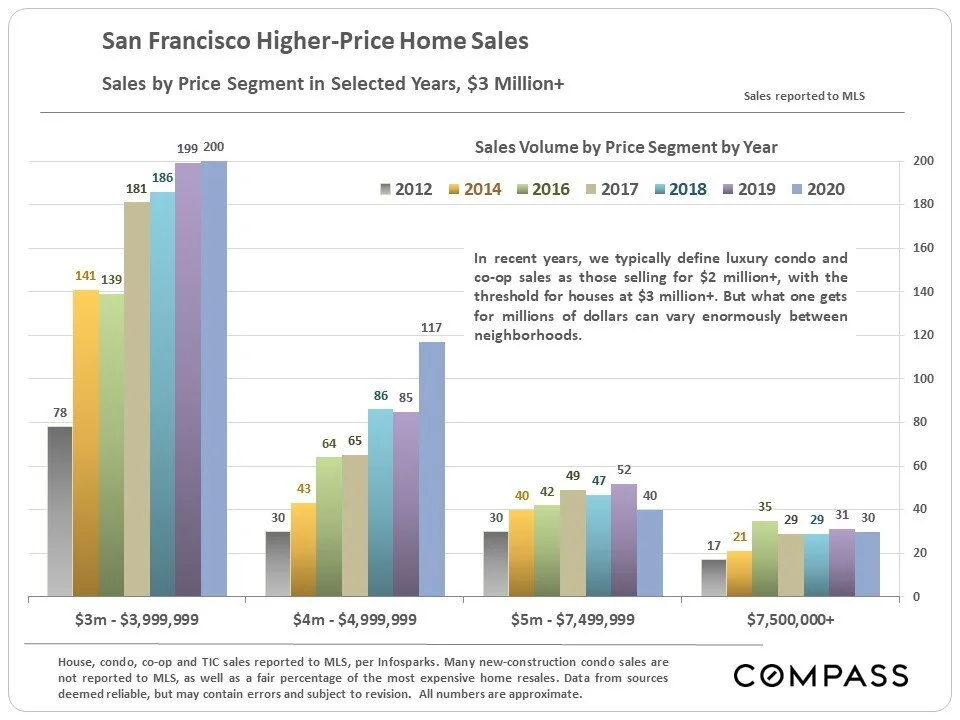

San Francisco Luxury Home Sales

Here again we see how the pandemic had a deleterious effect on the sale of condos, especially luxury condos. Increased interest in SFRs drove up activity on luxury homes.

San Francisco Median House and Condo Prices

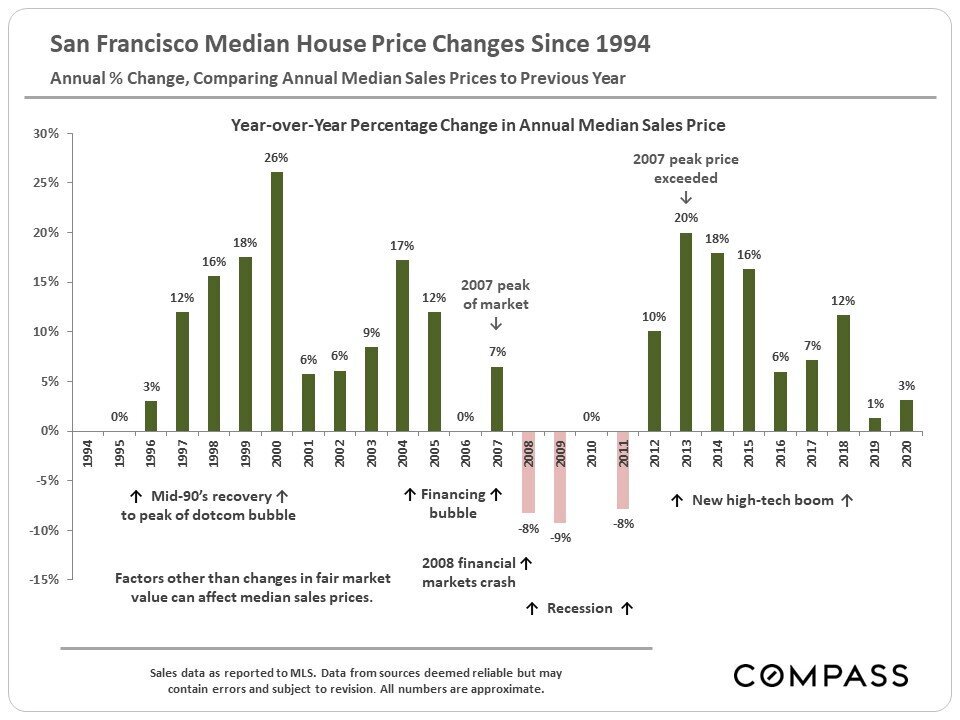

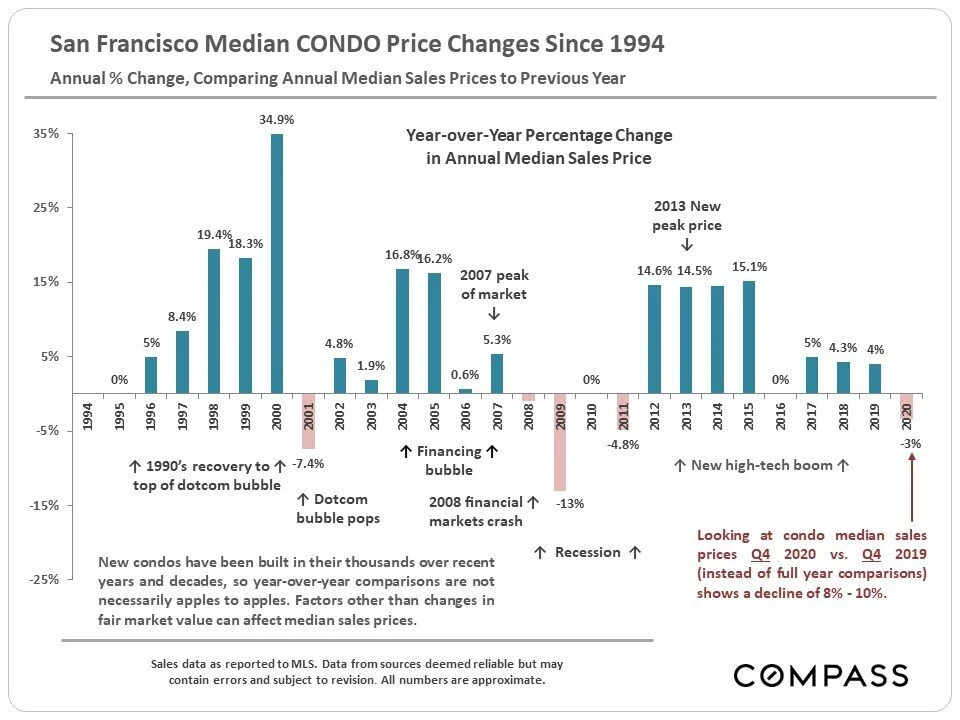

The dot-com bubble of the mid-90s, the financing bubble of the mid-2000s, and the high-tech boom of the 2010s significantly drove up pricing of homes in San Francisco.

Unlike SFRs, thousands of new condos have been built in recent years, so year-over-year comparisons are not necessarily reflective of pricing trends. Here we do see that the pandemic had a deflating effect on condo pricing, down 8-10% year over year from 2019 to 2020.

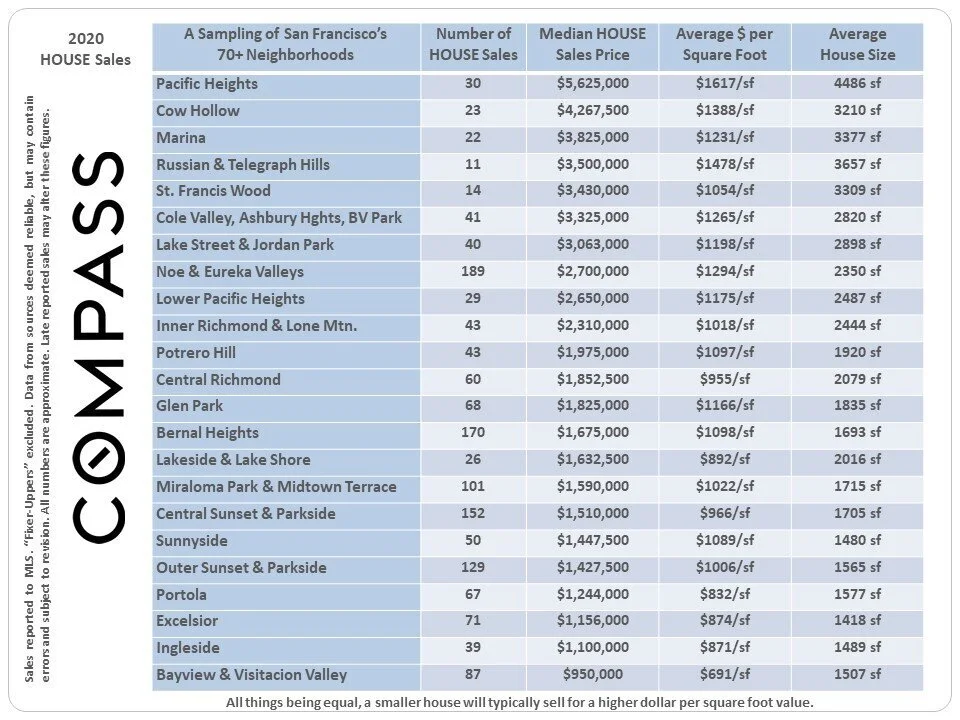

Bargain hunters take note of the southern and western neighborhoods that tend to have lower pricing per square foot than more prestigious areas.

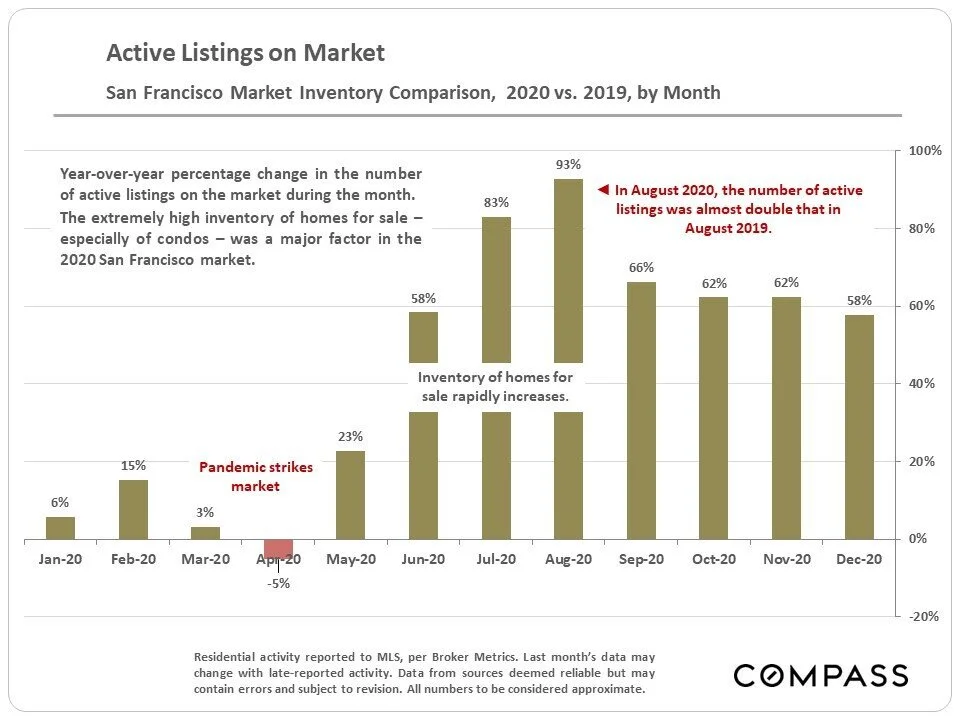

Active Listings on Market

Again, in the early days of the pandemic, the market flattened out drastically. As things opened up, listings flooded the market. In August 2020, the number of active listings was almost double that of the previous year. The extremely high inventory of homes for sale, especially of condos, was a major factor in the 2020 San Francisco market.

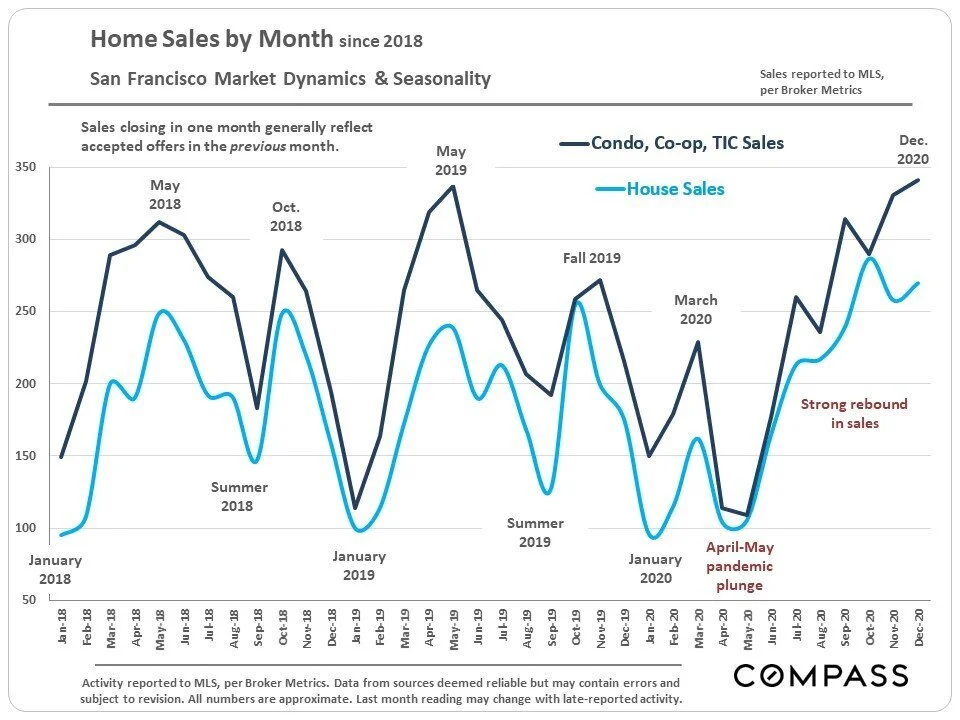

San Francisco Home Sales by Month, January 2018-December 2020

The pandemic upended our typical pattern of strong spring and fall selling seasons, cratering in the spring of 2020 and peaking late in the year.

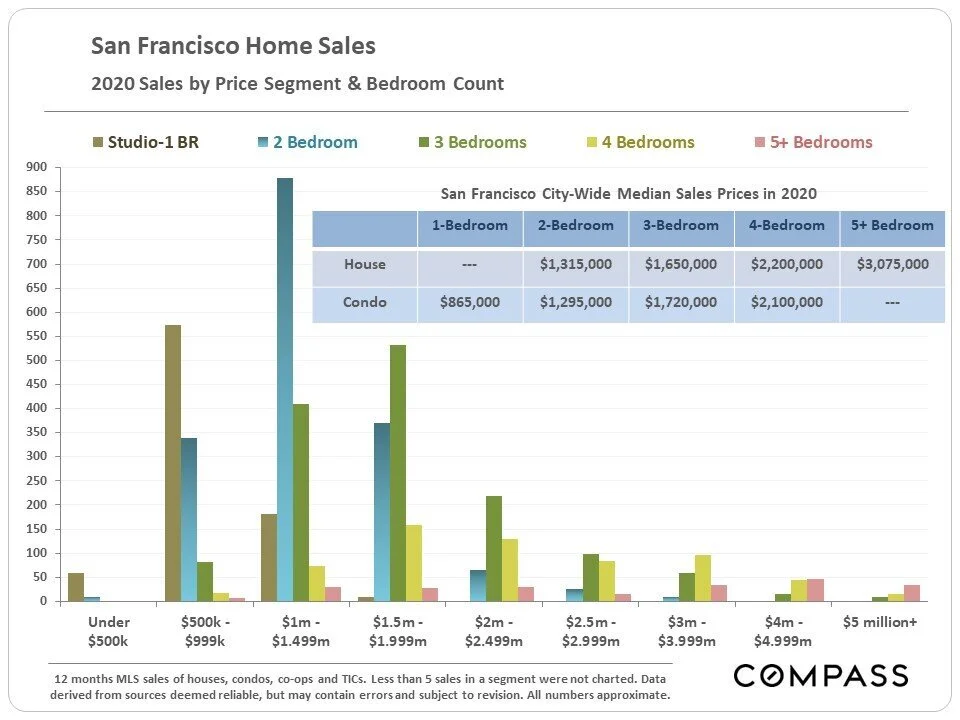

San Francisco Home Sales by Price Segment & Bedroom Count

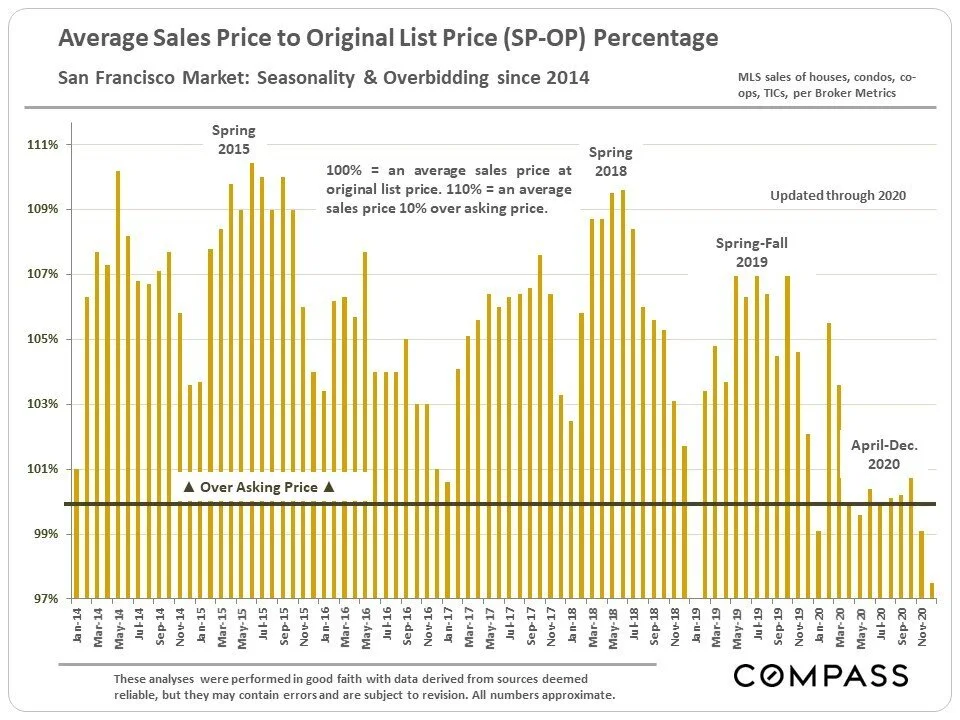

Average Sales Price to Original List Price Percentage

In a market where overbidding is de rigueur, the pandemic brought prices down, with many sales coming in at or even under original asking price. I think this is a trend we can expect to continue well into 2021, especially for condos, making this potentially a good buyer’s market.