November 2022 Market Report

Photo by Robert Forcadilla on Unsplash

After a brief rebound in market activity in August, pursuant to what turned out to be a very temporary decline in interest rates and an associated rebound in financial markets, macroeconomic conditions shifted again – with interest rates climbing rapidly to a 20-year high – which took a toll on early autumn, in Bay Area real estate markets. Though across the Bay Area, thousands of homes continued to be sold – a significant, but declining proportion still selling quickly over list price – the general trend was one of cooling demand, less competition, and declining sales. And, after years of conclusively holding the balance of power, sellers have reacted to the changing circumstances in different ways: Besides increased price reductions since spring, the number of new listings coming on market is well down year over year, and a much higher percentage of listings than normal is being removed from the market without selling. The economy and housing market remain in a period of adjustment, causing many people to be more cautious as they wait to see how things will settle out.

All these factors added up in San Francisco to October 2022 having the lowest number of October home sales since 2011. On a year-over-year basis, higher-price home sales of $3 million+ fell further (-43%) than the general market (-38%) in October.

The market now enters the 2-month holiday period which typically sees the year’s lowest levels of activity: The numbers of new listings and of listings going into contract usually plunge to their annual nadirs, and an increasing percentage of sellers, especially in higher price segments, pull their homes off the market to await the new year. (Many listings taken off market in November and December will presumably be relisted in Q1 2023.) Still, buying and selling continues, though at reduced levels, and this can be an excellent time for buyers to aggressively negotiate prices.

Market dynamics and statistics vary by county, property type and price segment.

San Francisco House Price Trends since 1990

Monthly Median House Sales Prices, 3-Month Rolling Average

3-month rolling average of monthly median sales prices for “existing” houses, per CA Association of Realtors or NorCal MLS Alliance. 2-period moving trend line. Analysis may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

Median sales price is that price at which half the sales occurred for more and half for less. It is a very general statistic, disguising an enormous range of sales prices in the underlying sales. It is often affected by other factors besides changes in fair market value. Monthly and seasonal fluctuations are common, which explain many of the regular ups and downs in this chart. Longer-term trends are much more meaningful than short-term changes.

Year over year, the 3-month rolling, median house sales price in October 2022, $1,650,000, was down a little over 8%.

San Francisco Condo Price Trends since 2005

3-Month Rolling, Median 2-BR Condo Sales Prices

Year over year, the 3-month rolling, median 2-bedroom condo sales price in October 2022, $1,250,000, was down almost 7.5%.

San Francisco HOUSE Sales Statistics

Summer-Fall 2022 Market*

A Sampling of San Francisco’s 70+ Neighborhoods

| Selected San Francisco Neighborhoods | Number of Sales | Median Sales Price | Median $/Sq. Ft. | Median Sq.Ft. | Avg. Days on Market | Sales within 30 Days | Highest Sale in Period |

|---|---|---|---|---|---|---|---|

| Pacific & Presidio Heights | 16 | $5,539,000 | $1403 | 3604 | 21 days | 75% | $34,500,000 |

| St. Francis Wood | 5 | $3,525,000 | $1420 | 3423 | 12 days | 100% | $7,100,000 |

| Marina & Cow Hollow | 17 | $3,456,000 | $1577 | 2637 | 19 days | 82% | $14,500,000 |

| Cole Valley, Ashbury Heights | 15 | $3,415,000 | $1169 | 2657 | 19 days | 93% | $4,220,000 |

| Lake Street & Jordan Park | 10 | $3,385,000 | $1397 | 2577 | 19 days | 80% | $4,999,999 |

| Noe & Eureka Valleys | 59 | $2,750,000 | $1377 | 2073 | 17 days | 84% | $31,000,000 |

| Lwr Pac Hts, Hayes Vly, NoPa | 6 | $2,737,500 | $1206 | 2521 | 21 days | 50% | $5,250,000 |

| Inner Richmond, Lone Mtn. | 11 | $2,175,000 | $1124 | 2240 | 18 days | 81% | $3,500,000 |

| Glen Park | 28 | $1,854,000 | $1180 | 1740 | 19 days | 75% | $4,000,000 |

| Inner Sunset, GG Heights | 29 | $1,825,000 | $963 | 2030 | 20 days | 75% | $3,000,000 |

| Miraloma Park, Midtown Ter. | 29 | $1,700,000 | $1117 | 1549 | 20 days | 79% | $3,072,000 |

| Bernal Heights | 48 | $1,680,000 | $1059 | 1633 | 23 days | 68% | $3,100,000 |

| Central Sunset & Parkside | 61 | $1,580,000 | $1012 | 1582 | 22 days | 73% | $2,750,000 |

| Outer Sunset & Parkside | 71 | $1,495,000 | $1058 | 1500 | 20 days | 84% | $2,950,000 |

| Excelsior & Portola | 47 | $1,200,000 | $881 | 1317 | 26 days | 63% | $1,825,000 |

| Ingleside & Oceanview | 19 | $1,200,000 | $815 | 1320 sq.ft. | 26 days | 73% | $1,760,000 |

| Bayview & Silver Terrace | 26 | $1,062,500 | $719 | 1418 sq.ft. | 29 days | 50% | $1,490,000 |

San Francisco 2-BR CONDO Sales Statistics

Summer-Fall 2022: 2-Bedroom, 2-Bath Condos*

| Selected San Francisco Neighborhoods | # of 2/2 Sales | Median Sales Price | Median $/Sq.Ft. | Median Sq.Ft. | Avg. Days on Market | Sales within 30 Days | Highest Condo Sale (all sizes) |

|---|---|---|---|---|---|---|---|

| Cow Hollow & Marina | 8 | $2,081,500 | $1367 | 1426 | 17 days | 75% | $3,300,000 |

| Russian Hill | 10 | $1,802,500 | $1347 | 1550 | 17 days | 80% | $29,000,000 |

| Nob Hill | 6 | $1,587,500 | $1115 | 1268 | 37 days | 50% | $4,299,000 |

| Noe, Eureka & Cole Valleys | 34 | $1,500,000 | $1157 | 1330 | 26 days | 70% | $3,595,000 |

| Pacific & Presidio Heights | 16 | $1,475,000 | $1101 | 1299 | 39 days | 50% | $4,700,000 |

| Hayes Vly, NoPa, Alamo Sq. | 10 | $1,425,000 | $1167 | 1225 | 19 days | 70% | $2,300,000 |

| South Beach | 37 | $1,395,000 | $1153 | 1280 | 57 days | 27% | $10,500,000 |

| Inner Richmond, Lake Street, Lone Mountain | 8 | $1,380,000 | $1249 | 1332 | 14 days | 87% | $2,500,000 |

| Lower Pacific Heights | 14 | $1,350,000 | $1090 | 1170 | 36 days | 42% | $2,325,000 |

| Mission Bay | 25 | $1,312,000 | $1135 | 1237 | 49 days | 52% | $2,180,000 |

| Inner Mission, Dogpatch | 17 | $1,250,000 | $1015 | 1204 | 46 days | 29% | $1,900,000 |

| Potrero Hill | 7 | $1,127,000 | $1144 | 942 | 66 days | 28% | $1,610,000 |

| South of Market (SoMa) | 15 | $925,000 | $788 | 1106 sq.ft. | 70 days | 13% | $3,180,000 |

| Ingleside Heights | 6 | $744,000 | $776 | 968 sq.ft. | 35 days | 66% | $708,800 |

| Hunter’s, Candlestick Points | 6 | $740,000 | $669 | 1109 sq.ft. | 45 days | 16% | $978,000 |

| null | |||||||

| null |

Within compilations of sales, gradations in quality of location, construction, condition, amenities, views, and home size are often vast.

* 4 months sales reported to NorCal MLS Alliance, through late October. “Sales within 30 days” refers to %of home sales into contract within 30 days. Data derived from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate. Outlier data adjusted when identified. Not all sales are reported to MLS. Some “highest” sales included here were not reported to MLS.

Monthly Sales Volume*

San Francisco Market Dynamics: Year-over-Year Comparison

*House, condo, TIC, co-op, townhouse sales reported to NorCal MLS Alliance, per Infosparks. Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate. Last month estimated based on available data, and may change with late-reported activity. Does not include sales unreported to MLS.

Comparing October 2022 with October 2021, the number of San Francisco home sales was down about 38% (and the lowest October total since 2011).

Sales in one month mostly reflect accepted-offer activity in the previous month.

Monthly Sales Volume – Longer-Term Trends

San Francisco Market Dynamics & Seasonality

House, condo, TIC, co-op sales reported to NorCal MLS Alliance, per Infosparks. Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate. Last month estimated based on data available early the next month, and may change with late reported sales.

As illustrated, sales volume usually ebbs and flows by season: Up in spring, down in summer, back up in fall, and way down in mid-winter.

Higher-Price Home Sales Volume

San Francisco Market Dynamics: Sales $3 Million+

House, condo, TIC, co-op, townhouse sales reported to NorCal MLS Alliance, per Infosparks. Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate. Last month estimated based on available data, and may change with late-reported activity. Does not include sales unreported to MLS.

Comparing October 2022 with October 2021, the number of $3m+ home sales in San Francisco was down about 43%.

Sales in one month mostly reflect accepted-offer activity in the previous month.

San Francisco Higher-Price Home Sales, Longer-Term Perspective

Homes Selling for $3 Million+: Market Dynamics & Seasonality

Sales reported to NorCal MLS Alliance, per Infosparks. Does not include sales unreported to MLS: Not all sales are reported. Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate, and may change with late-reported activity.

The number of higher-price sales typically ebbs and flows dramatically by season. Sales usually follow the time of offers being accepted by 3 to 5 weeks.

Luxury Home Sales, $5 Million+*

Bay Area Luxury Home Market Dynamics

*Per residential sales reported to NorCal MLS Alliance for 10 Bay Area Counties, Napa to Monterey (excluding Solano), per Infosparks. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales. Not all luxury sales are reported to MLS.

Year over year, October 2022 Bay Area $5 million+ home sales were down about 43%.

Mortgage Interest Rates, Long-Term Trends since 1976

30-Year Conforming Fixed-Rate Loans, Weekly Average Readings

Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US. Data from sources deemed reliable but not guaranteed. All numbers approximate.

November 3, 2022 Rates

30-Year Fixed 6.95%

15-Year Fixed 6.29%

5/1 Adjustable 5.95%

Months Supply of Inventory (of Active Listings on Market)

San Francisco Real Estate Market since 2018

3-month rolling average monthly data for transactions reported to SFAR MLS, per Broker Metrics. Will not include new-project condo activity unreported to MLS. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers very approximate, and may change with late-reported activity.

3-month rolling average of monthly readings: MSI measures how long it would take to sell the current inventory of active listings at the current rate of sale. The lower the MSI, the stronger the buyer demand as compared to the supply of listings on the market. This statistic also typically fluctuates according to seasonal trends in listing and sales activity.

The pandemic initially significantly weakened SF markets, especially for condos, which went into market-recession territory. A dramatic recovery began in autumn 2020 to begin the pandemic boom, but began cooling in spring 2022. The house market has remained stronger than the condo, co-op and TIC market.

Months Supply of Inventory (MSI) by Price Segment

San Francisco Market Dynamics*

* Analysis of NorCal MLS Alliance active and coming-soon listings vs. the approximate rate of sales as of 11/1/22. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and change constantly with market activity. Not all listings and sales are posted to MLS.

Months Supply of Inventory (MSI) measures how long it would approximately take to sell the current inventory of active and coming-soon listings at the recent rate of sale. The lower the MSI, the stronger the demand as compared to the supply of listings for sale. It is not unusual for the most expensive home segments to have higher readings.

Within the overall market, the MSI for houses has been running substantially lower than that for condos, co-ops and TICs. The lowest price segment on this chart is dominated by condo and TIC listings. This analysis does not include new-project condo listings and sales unreported to MLS.

Most of these MSI figures below are not particularly high by long-term standards, but are running significantly higher than during the peak market of 2021-early 2022.

New Listings Coming on Market

San Francisco Market Dynamics & Seasonality

Per Realtor.com Research: https://www.realtor.com/research/data/, listings posted on site. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers should be considered approximate.

San Francisco Homes Market

Active & Coming-Soon Listings on 1st of Month*

* Houses, condos, co-ops, TICs, townhouses: Active/Coming-Soon listings posted to NorCal MLS Alliance. Does not include new-project condos not listed on MLS. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate. The # of active listings changes constantly.

The # of active listings on a given day is affected by 1) the # of new listings coming on market, 2) how quickly buyers put them into contract, 3) the sustained heat of the market over time, and 4) sellers pulling their homes off the market without selling.

As of 11/1/22, 69% of these listings were condos, co-ops, townhouses and TICs, and 31% were houses.

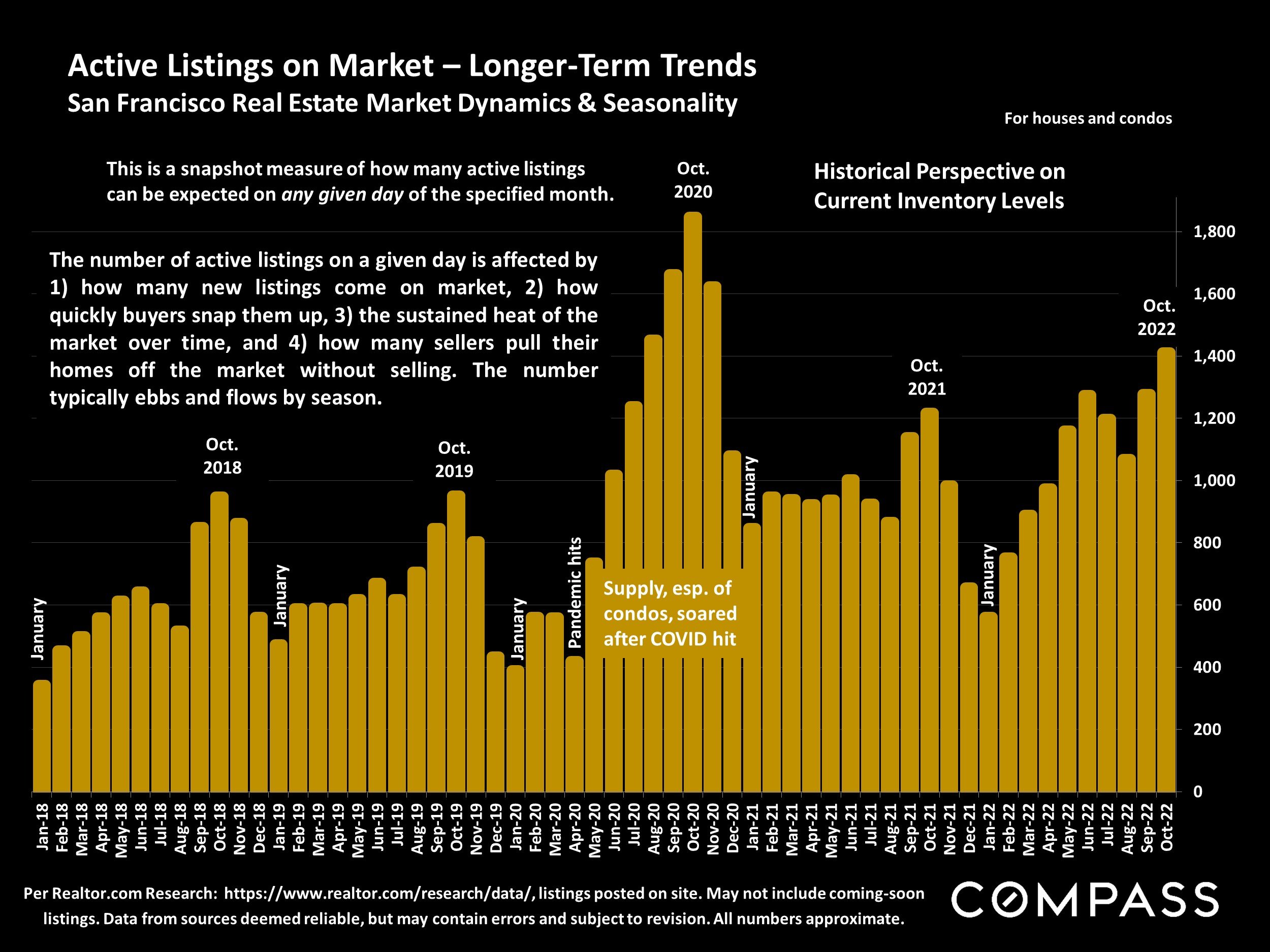

Active Listings on Market – Longer-Term Trends

San Francisco Real Estate Market Dynamics & Seasonality

Per Realtor.com Research: https://www.realtor.com/research/data/, listings posted on site. May not include coming-soon listings. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate.

This is a snapshot measure of how many active listings can be expected on any given day of the specified month.

The number of active listings on a given day is affected by 1) how many new listings come on market, 2) how quickly buyers snap them up, 3) the sustained heat of the market over time, and 4) how many sellers pull their homes off the market without selling. The number typically ebbs and flows by season.

Listings Accepting Offers- Longer-Term Trends

San Francisco Market Dynamics & Seasonality

Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate. Last month numbers estimated based on available data, and may change with late reported activity.

The number of listings accepting offers is a leading indicator of sales volume in the following 3 to 6 weeks.

It’s not unusual for market activity to slow down dramatically in mid-late summer, before rebounding during the autumn market (prior to the big mid-winter drop.)

Price Reductions on Active Listings

San Francisco Market Dynamics & Seasonality

Per Realtor.com Research: https://www.realtor.com/research/data/, listings posted to site. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate.

The number of price reductions typically ebbs and flows by season, but can also be affected by specific events in the economy and the market.

Price reductions usually peak in October before the mid-winter slowdown begins in November.

Listings Expired/Withdrawn Without Selling*

As a % of Active Listings: Bay Area Market Dynamics, 2021-2022

*As reported for 11 Bay Area Counties, per Broker Metrics. Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate, and may change with late-reported activity.

This statistic compares the number of Bay Area listings expired or withdrawn – i.e. taken off the market without selling – to the number of active listings for sale during the month. It typically peaks in December for the holiday slowdown. Since spring 2022, the % of unsold listings pulled off the market has tripled, substantially lowering inventory levels.

Much higher percentages of active listings are being removed from the market without being sold. This affects many statistics of supply and demand.

Overbidding List Prices in San Francisco

Percentage of Home Sales Closing over List Price, since 2018

Sales data reported to NORCAL MLS® ALLIANCE, per Infosparks. Reflecting the percentage of sales closing at sales prices over the final list prices. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate, and may change with late-reported sales.

Sales in 1 month mostly reflect market dynamics in the previous month. Seasonal ebbs and flows are typical.

In the latest month, 50% of sales closed over final list price, down from 73% in April.

Average Sales Price to Original List Price Percentage

San Francisco Overbidding: Market Dynamics & Seasonality

Sales reported to NorCal MLS Alliance, per Infosparks. Data derived from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

Houses have higher average overbidding percentages than condos, but both have plunged since April 2022. This statistic also fluctuates by season, and is a lagging indicator of market activity 3-6 weeks earlier.

Average Days on Market – Sold Listings

San Francisco Market Dynamics & Seasonality

2-month-period trend lines: Sales reported to NorCal MLS Alliance, per Infosparks. “Condos” include co-op and TIC sales. Data derived from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

This statistic ebbs and flows seasonally, and is a lagging indicator of market activity 3-6 weeks earlier.

Measuring how long it takes for sold listings to accept offers. Houses have much lower average days-on-market readings than condos. Numbers have generally been climbing rapidly from April 2022. Chart illustrates 2-month-moving trend.

Average Days on Market for Active Listings

San Francisco Market Dynamics, by Price Segment*

* Cumulative days-on-market analysis of NorCal MLS Alliance active listings with days on market of 3 to 200 days as of 11/2/22. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and change constantly with market activity.

Looking at average days on market for ACTIVE listings (no offer yet accepted) since they were first posted for sale. This includes homes that recently came on market and homes that have been on the market for months without selling. With the market cooling since spring, the average days on market for active, unsold listings have been climbing.

The average days on market for homes currently for sale, priced under $8 million, are currently running about 7 to 8 weeks.

The average $8m+ listing has been on the market for 10 weeks without selling.

Selected Excerpts from National Survey of Home Buyers & Sellers

By the National Association of REALTORS® (NAR)

“The median distance between the home that recent buyers purchased and the home from which they moved was 50 miles – a record high and more than a three-fold jump from a median of 15 miles from 2018 through 2021.”

“The shares of buyers who purchased homes in small towns (29%) and rural areas (19%) were the highest ever recorded, while the shares of homes purchased in suburban (39%) and urban (10%) locations declined from one year ago.”

“First-time buyers made up only 26% of all buyers, down from 34% last year and a peak of 50% in 2010 during the First-Time Home Buyer Tax Credit. The age of the typical first-time buyer was 36 years – up from 33 years one year ago – and the typical repeat buyer's age climbed to 59 years from 56 years in 2021. Both ages are the highest in the history of the data set.”

“Seventy-eight percent of recent buyers financed their home purchase, down from 87% last year and driven by the increased share of repeat buyers who paid all cash.”

“The median age of home sellers was 60 years, up from 56 years one year ago. Sellers typically lived in their home for 10 years before selling.”

11/3/22 news release: https://www.nar.realtor/newsroom/nar-finds-share-of-first-time-home-buyers-smaller-older-than-ever-before. How national trends apply to the Bay Area is uncertain. Based on limited National Association of REALTORS® survey of buyers and sellers, not on hard data collected upon hundreds of thousands of closed transactions.

Our reports are not intended to convince you regarding a course of action or to predict the future, but to provide, to the best of our ability, straightforward information and good-faith analysis to assist you in making your own informed decisions. Statistics should be considered very general indicators, and all numbers should be considered approximate. How they apply to any particular property is unknown without a specific comparative market analysis.

Statistics are generalities, essentially summaries of widely disparate data generated by dozens, hundreds or thousands of unique, individual sales occurring within different time periods. They are best seen not as precise measurements, but as broad, comparative indicators, with reasonable margins of error. Anomalous fluctuations in statistics are not uncommon, especially in smaller, expensive market segments. Last period data should be considered estimates that may change with late-reported data. Different analytics programs sometimes define statistics – such as “active listings,” “days on market,” and “months supply of inventory” – differently: what is most meaningful are not specific calculations but the trends they illustrate. Most listing and sales data derives from the local or regional multi-listing service (MLS) of the area specified in the analysis, but not all listings or sales are reported to MLS and these won’t be reflected in the data. “Homes” signifies real-property, single-household housing units: houses, condos, co-ops, townhouses, duets and TICs (but not mobile homes), as applicable to each market. City/town names refer specifically to the named cities and towns, unless otherwise delineated. Multi-county metro areas will be specified as such. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers to be considered approximate.

Many aspects of value cannot be adequately reflected in median and average statistics: curb appeal, age, condition, amenities, views, lot size, quality of outdoor space, “bonus” rooms, additional parking, quality of location within the neighborhood, and so on. How any of these statistics apply to any particular home is unknown without a specific comparative market analysis.

Median Sales Price is that price at which half the properties sold for more and half for less. It may be affected by seasonality, “unusual” events, or changes in inventory and buying trends, as well as by changes in fair market value. The median sales price for an area will often conceal an enormous variety of sales prices in the underlying individual sales.

Dollar per Square Foot is based upon the home’s interior living space and does not include garages, unfinished attics and basements, rooms built without permit, patios, decks or yards (though all those can add value to a home). These figures are usually derived from appraisals or tax records, but are sometimes unreliable (especially for older homes) or unreported altogether. The calculation can only be made on those home sales that reported square footage.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.