September 2024 Market Report

The August market was basically in a holding pattern, following typical seasonal trends, as the summer holidays drew to a close amid declining interest rates, indications of impending cuts in the Fed’s benchmark rate, improving housing affordability, substantial financial market volatility, and a huge helping of presidential election news. The autumn selling season, just begun, typically sees significant market activity before the big mid-winter slowdown begins in late November, and some expect a very substantial rebound in demand due to interest rate declines.

"The time has come for policy to adjust…the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks…My confidence has grown that inflation is on a sustainable path back to 2 percent.” — Jerome Powell, Chairman, Federal Reserve Bank, 8/23/24

“We forecast mortgage rates to gradually decline in the coming quarters and anticipate a significant surge in homebuying demand, mainly from the first-time homebuyers left at the margins. However, the tight inventory is still expected to limit home sales. We expect home sales to increase modestly the remainder of the year and home prices to rise 2.1% in 2024.” — Freddie Mac Research (FHLMC), 8/22/24

“Consumers’ short- and long-run economic outlook improved [in August], with both figures reaching their most favorable levels since April 2024 and a particularly sizable 10% improvement for long-run expectations that was seen across age and income groups.” — University of Michigan, Survey of Consumers, 8/30/24

“Latest macroeconomic data suggests that the economy remains solid, with the cooling trend in inflation continuing at the start of Q3 2024. Both consumers and business leaders feel upbeat in general and have a positive outlook about the near future. With the Fed expected to adjust rates downward in their next few meetings, the housing market should pick up some momentum throughout the rest of the year. There are challenges...The ongoing insurance crisis, for example…has presented difficulties for homebuying and could remain a major headache for the market [over] the next couple of years.” — California Association of Realtors, 9/6/24

“Presidential elections have little impact on home sales…[ultimately] home purchases are usually life decisions rather than political ones.” — John Burns Research & Consulting, 7/30/24

This report includes a deep dive into San Francisco neighborhood values and characteristics along with a comprehensive review of general market indicators.

Mortgage Interest Rates in 2023-2024

30-Year Conforming Fixed-Rate Loans, Weekly Average Readings*

*Freddie Mac (FHLMC), 30-Year Fixed Rate Mortgage Weekly Average: https://www.freddiemac.com/pmms. Data from sources deemed reliable. Different sources of mortgage data sometimes vary in their determinations of daily and weekly rates. Data from sources deemed reliable but may contain errors. All numbers approximate.

Per Freddie Mac (FHLMC), on September 5, 2024, the weekly average, 30-year, conforming-loan interest rate remained at 6.35%, its lowest reading since May 2023.

Rates vary widely according to the property, price, borrower and lender.

2024 YTD Home Sales by Price Segment*

San Francisco Residential Market

*2024 sales reported to NorCal MLS Alliance by late August 2024. Not all sales are reported to MLS, including many new-project condo sales. Data from sources deemed reliable, but may contain errors and subject to revision. Percentages rounded. All numbers approximate. New sales are reported constantly.

Sales by Property Type*:

House 47%

Condo* 45%

TIC 6%

Co-op 1.5%

Townhouse <1%

Home sales:

27% of SF home sales were under $1,000,000.

49.5% of SF home sales were $1,000,000 to $1,999,999.

14% of home sales were $2,000,000 to $2,999,999.

7% of home sales were $3,000,000 to $4,999,999.

12 sales were reported to MLS for $10 million+ in 2024 YTD, and a $70 million sale occurred off-MLS.

Condo, Co-op & TIC Sales*:

19% of sales $3,000,000+

35% of sales $2m - $2,999,999

40% of sales $1.5m - $1,999,999

52% of sales $1m - $1,499,999

82% of sales under $1,000,000

San Francisco HOUSE Price Trends since 1990

Monthly Median House Sales Prices, 3-Month Rolling

3-month rolling average of monthly median sales prices for “existing” houses, per CA Association of Realtors or 3-month rolling median per NorCal MLS Alliance. Analysis may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

The 3-month-rolling median house sales price in August 2024 continued to drop from the typical spring peak, but was up about 3.5% year over year.

Median sales price is that price at which half the sales occurred for more and half for less. It is a very general statistic, disguising an enormous range of sales prices in the underlying sales. It is often affected by other factors besides changes in fair market value. Monthly and seasonal fluctuations are common, which explain many of the regular ups and downs in this chart. More often than not, median sales prices peak for the year in spring.

San Francisco CONDO Price Trends since 2005

Median Condo Sales Price, 3-Month Rolling

3-month rolling median condo sales prices reported to NorCal MLS Alliance, per Infosparks. Analysis may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

The 3-month-rolling median condo sales price in August 2024 was down about 2% year over year.

Generally speaking, over the last 5-6 years, Bay Area median condo sales prices have not seen the appreciation rates common in house markets.

Median sales price is that price at which half the sales occurred for more and half for less. It is a very general statistic, often affected by other factors besides changes in fair market value. Monthly and seasonal fluctuations are common, and longer-term trends are more meaningful than short-term changes.

San Francisco CONDO Prices: Downtown vs. Non-Downtown

6-Month-Rolling, Median Condo Sales Prices since 2005*

*6-month rolling median condo sales values reported to NorCal MLS Alliance, per Infosparks. Analysis may contain errors and subject to revision. Does not include new-project sales unreported to MLS. All numbers approximate, and may change with late-reported sales.

Comparing median condo sales prices in the greater Downtown/South of Market/Civic Center area (the center of large-project, new-condo construction, office buildings and high-tech employment) – delineated by the white line – with the rest of San Francisco (mostly smaller, older buildings, in less urban environments) – delineated by the green line.

Median sales prices also vary widely within these two broad regions.

San Francisco Value Trends since 2005

3-Month-Rolling, Median Dollar per Square Foot Values*

*3-month rolling median house sales values reported to NorCal MLS Alliance, per Infosparks. Analysis may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

Until the pandemic, the median $/sq.ft. value for condos (green columns) ran significantly higher than for houses, but that is no longer the case.

Median $/sq.ft. value is a general statistic, disguising an enormous range of values in the underlying sales. It is often affected by other factors besides changes in fair market value. Monthly and seasonal fluctuations are common, which explain many of the regular ups and downs in this chart.

San Francisco HOUSE Markets

By Neighborhood & Realtor District

Realtor districts can contain neighborhoods of widely varying demographics and characteristics, housing types and values: The numbers in this report are generalities, and how they apply to any particular property is unknown without a specific comparative market analysis. Statistics are generalities and anomalous fluctuations in statistics are not uncommon, especially in smaller district and neighborhood markets with fewer sales and wide ranges in sales prices. The time period for each analysis is delineated at the bottom of the chart.

San Francisco House Prices

Median HOUSE Sales Prices – Selected Neighborhoods*

*2024 sales reported to NorCal MLS Alliance through mid-August 2024. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate and may change with late-reported sales.

This is a sampling of values across some of San Francisco’s 70+ neighborhoods.

Median sales price is that price at which half the sales occurred for more and half for less. It is a very general measurement of value that disguises a wide range of prices in the underlying sales, and how it applies to any particular home is unknown without a specific comparative market analysis.

Many factors affect home values: architectural style, quality of construction, square footage, condition, amenities, light, views, privacy, outdoor space, “bonus” rooms, additional parking, quality of location within the neighborhood, and so on.

San Francisco House Values

Median HOUSE $/Sq.Ft. Values – Selected Neighborhoods*

*2024 sales reported to NorCal MLS Alliance through mid-August 2024. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate and may change with late-reported sales.

This is a sampling of values across some of San Francisco’s 70+ neighborhoods.

Median $/sq.ft. value is a very general measurement, and how it applies to any particular home is unknown without a specific comparative market analysis. All things being equal, a smaller home will typically sell for a higher $/sq.ft. value (though all things are rarely equal).

The calculation of dollar per square foot is based on interior living space and doesn’t include garages, attics, basements, rooms built without permit, decks, patios or lot size (though all these can add value to the home).

San Francisco Median House Sizes

Median HOUSE Square Footage – Selected Neighborhoods*

*2024 sales reported to NorCal MLS Alliance through mid-August 2024. Data from sources deemed reliable, but may contain errors and subject to revision. Not all sales report square footage. All numbers approximate and may change with late-reported sales.

Comparing median sales prices between neighborhoods is not apples to apples, since the median sizes of homes (and other characteristics) vary so widely. Generally speaking, the most expensive neighborhoods have both the largest homes and the highest dollar per square foot values.

Square footage is based upon interior living space and doesn’t include garages, attics, basements, rooms built without permit, decks, patios or lot size.

Average Days on Market (DOM) to Acceptance of Offer

San Francisco HOUSE Markets by Realtor District*

*House sales reported to NorCal MLS Alliance January-July 2024, per Infosparks. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate.

Speed of Sale: Lower days-on-market generally signify stronger buyer demand.

Percentage of Listings Selling Over List Price

San Francisco HOUSE Markets by Realtor District*

*House sales reported to NorCal MLS Alliance January-July 2024, per Infosparks. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate.

Higher percentages of sales over list price typically signify greater buyer competition for new listings, but this statistic can be affected by strategic underpricing strategies by sellers and listing agents.

Average Overbid & Underbid Percentages

San Francisco HOUSE Markets by Realtor District*

*House sales reported to NorCal MLS Alliance January-July 2024, per Infosparks. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate.

Generally speaking, the more buyers compete for a limited supply of appealing and well-priced listings, the higher the average overbid percentage above asking price. It’s not unusual for the most expensive markets to see lower or negative percentages, though that is not always the case.

In San Francisco, the house market has seen much more heated overbidding than the condo market in recent years. This statistic can be affected by strategic underpricing strategies by sellers and listing agents.

San Francisco Neighborhoods with Most House Sales

San Francisco’s Largest HOUSE Markets, 2024 YTD*

*Sales reported to NorCal MLS Alliance, January to mid-August 2024. Not all sales are reported. Data from sources deemed reliable, but may contain errors and subject to revision. Sales numbers approximate and change constantly.

San Francisco has 70+ named neighborhoods, some of them very small, with few sales. These neighborhoods or districts had the highest numbers of house sales in 2024 YTD.*

The architectural character, size and prices of houses vary widely between neighborhoods – but the vast majority were built before 1960.

San Francisco Higher Price & Luxury HOUSE Market

House Sales of $4,000,000+, by District, 12 Months Sales*

*12 months sales and pending sales reported to NorCal MLS Alliance by mid-August 2024. Not all luxury home sales are reported. Some pending sales may not close. Neighborhood groupings correspond to SF Realtor districts, which often include adjacent neighborhoods not listed. Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate.

There was also 1 sale in Golden Gate Heights (D2) for $5,550,000.

San Francisco CONDO Markets

By Neighborhood & Realtor District

Realtor districts can contain neighborhoods of widely varying demographics and characteristics, housing types and values: The numbers in this report are generalities, and how they apply to any particular property is unknown without a specific comparative market analysis. Statistics are generalities and anomalous fluctuations in statistics are not uncommon, especially in smaller district and neighborhood markets with fewer sales and wide ranges in sales prices. The time period for each analysis is delineated at the bottom of the chart.

San Francisco Condo Prices

Median CONDO Sales Prices – Selected Neighborhoods*

*2024 condo sales reported to NorCal MLS Alliance through mid-August 2024. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate and may change with late-reported sales.

This is a sampling of values across some of San Francisco’s 70+ neighborhoods.

Median sales price is that price at which half the sales occurred for more and half for less. Many factors affect condo prices: square footage, architectural style, views, quality of construction, the floor the unit is on, condition, HOA amenities and cost, deeded outdoor space, parking, and so on.

San Francisco Condo Values

Median CONDO $/Sq.Ft. Values – Selected Neighborhoods*

*2024 condo sales reported to NorCal MLS Alliance through mid-August 2024. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate and may change with late-reported sales.

This is a sampling of values across some of San Francisco’s 70+ neighborhoods.

The calculation of dollar per square foot is based on interior living space and doesn’t include common areas, parking spaces, rooms built without permit, storage rooms, decks or patios. All things being equal, a smaller unit will typically sell for a higher dollar per square foot value.

San Francisco Condo Sizes

Median CONDO Square Footage – Selected Neighborhoods*

*2024 condo sales reported to NorCal MLS Alliance through mid-August 2024. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate and may change with late-reported sales.

This is a sampling of values across some of San Francisco’s 70+ neighborhoods.

Comparing median sales prices between neighborhoods is not apples to apples, since the median size of units (as well as many other characteristics) vary so widely.

Average Days on Market (DOM) to Acceptance of Offer

Major San Francisco CONDO Markets by Realtor District*

*Condo sales reported to NorCal MLS Alliance January-July 2024, per Infosparks. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate.

Lower days-on-market generally signify stronger buyer demand, but there are a number of factors at play.

South Beach/SoMa/Mission Bay is the largest SF condo market, and center of new-project condo construction for decades. Van Ness-Civic Center is also dominated by larger, newer condo projects.

Percentage of Listings Selling Over List Price

Major San Francisco CONDO Markets by Realtor District*

*Condo sales reported to NorCal MLS Alliance January-July 2024, per Infosparks. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate.

Higher percentages of sales over list price typically signify more heated markets and greater buyer competition for new listings.

In Noe, Eureka & Cole Valleys; Corona Heights, 62% of listings sold over list price.

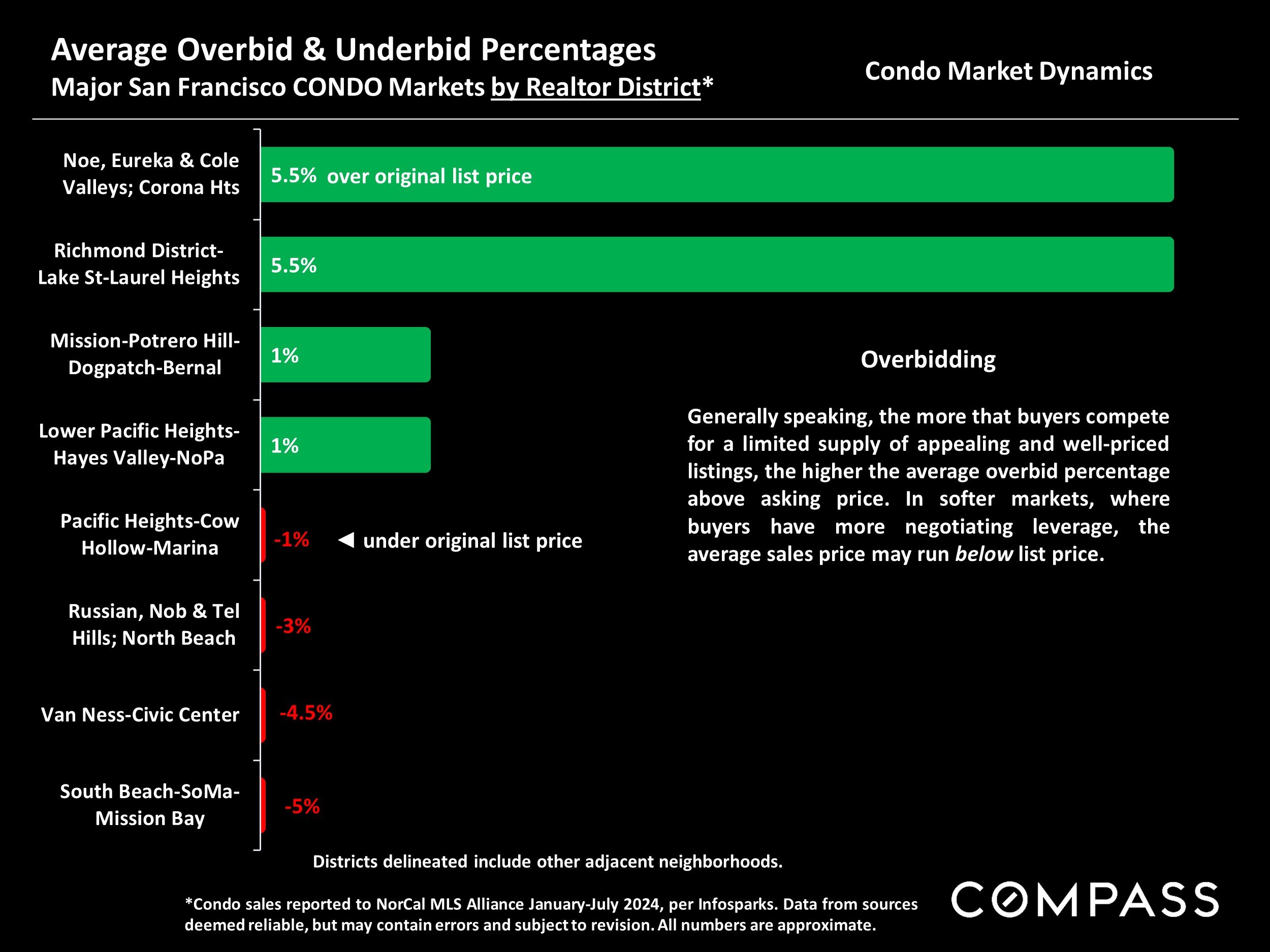

Average Overbid & Underbid Percentages

Major San Francisco CONDO Markets by Realtor District*

*Condo sales reported to NorCal MLS Alliance January-July 2024, per Infosparks. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate.

In Noe, Eureka & Cole Valleys; Corona Heights, as well as Richmond District-Lake St-Laurel Heights, condos sold for 5.5% over original list price on average.

Generally speaking, the more that buyers compete for a limited supply of appealing and well-priced listings, the higher the average overbid percentage above asking price. In softer markets, where buyers have more negotiating leverage, the average sales price may run below list price.

San Francisco Neighborhoods with Most Condo Sales

San Francisco’s Largest Condo Markets, 2024 YTD*

*Sales reported to NorCal MLS Alliance, January to mid-August 2024. Many new-project condo sales are not reported: These are mostly clustered in the greater South Beach/SoMa/Mission Bay/Civic Center region. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate and change constantly.

San Francisco has 70+ named neighborhoods. These neighborhoods or districts had the highest numbers of condo sales in 2024 YTD.*

The character of condo buildings varies immensely between neighborhoods, from Victorian & Edwardian flats to towering, new high-rise projects – with many other styles built in between.

San Francisco Luxury CONDO, CO-OP, TIC & TOWNHOUSE Market

Sales Prices of $2.5 Million+, by District, 12 Months Sales*

*12 months sales and pending sales reported to NorCal MLS Alliance by mid-August 2024. Not all luxury home sales are reported. Neighborhood groupings correspond to SF Realtor districts, which often include adjacent neighborhoods not listed. Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate.

Some new-project luxury condo sales are not reported to MLS. These projects are mostly concentrated in the South Beach, SoMa, Yerba Buena & Treasure Island neighborhoods (D9).

New Listings Coming on Market

San Francisco Market Dynamics & Seasonality

Per Realtor.com Research: https://www.realtor.com/research/data/, listings posted on site. Data from sources deemed reliable, but may contain errors and subject to revision. May not include “coming-soon” listings. All numbers should be considered approximate.

As is the usual trend in summer, the number of new listings has fallen from spring’s high. New-listing activity typically spikes back up dramatically in September, which often sees the highest number of new listings of the year.

Active & Coming-Soon Listings on 1st of Month*

San Francisco Homes Market

* Houses, condos, co-ops, TICs, townhouses: Active/Coming-Soon listings posted to NorCal MLS Alliance. Does not include new-project condos not listed on MLS. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate. The # of active listings changes constantly.

The number of active/coming-soon listings on September 1, 2024 was slightly down year over year - but falling within Labor Day weekend may have depressed the count. Of the listings for sale, 28% were houses, and 72% were condos, co-ops, TICs & townhouses.*

The # of active listings on a given day is affected by 1) the # of new listings coming on market, 2) how quickly buyers put them into contract, 3) the sustained heat of the market over time, and 4) sellers pulling their homes off the market without selling.

Listings Accepting Offers (Going into Contract)

San Francisco Market Dynamics & Seasonality

Residential activity reported to MLS, per Broker Metrics. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and may change with late-reported activity.

Though continuing to decline from spring in the usual seasonal trend, the number of listings going into contract (pending sale) in August 2024 was significantly higher year-over-year.

Autumn typically sees a substantial rebound in sales activity, fueled by a big jump in new listings coming on market.

The # of listings going into contract measures buyer demand, but is often impacted by the supply of new listings available to buy.

Monthly Home Sales Volume

San Francisco Market Dynamics & Seasonality

Sales of houses, condos, townhouses reported to NorCal MLS Alliance, per Infosparks. Data from sources deemed reliable but may contain errors and subject to revision. Last month estimated based on available information and may change with late reported sales. All numbers approximate.

So far in 2024 YTD, sales volume was 11% higher than the same period of 2023.

Over the past 3 months, 49% of SF sales were houses, and 51% were condos, co-ops, TICs and townhouses.

Sales in one month mostly reflect accepted offers in the previous month.

San Francisco Luxury House Sales*

Houses Selling for $5 Million+ since 2018

*Houses listings and sales reported to NorCal MLS Alliance, per Infosparks. Does not generally include listings and sales unreported to MLS. Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate, and may change with late-reported activity.

Spring is usually the period of highest sales volume for luxury homes, though it is not unusual for autumn to see a substantial spike up in activity after the typical summer slowdown.

So far in 2024 YTD, $5 million+ house sales are up 58% from the same period of 2023.

San Francisco Luxury Condo & Co-op Sales*

Units Selling for $2.5 Million+ since 2018

*Includes listings and sales of condos, co-ops, townhouses, TICs reported to NorCal MLS Alliance, per Infosparks. Does not include sales unreported to MLS, such as some new-project condos. Data from sources deemed reliable but may contain errors and subject to revision. All numbers approximate, and may change with late-reported activity.

So far in 2024 YTD, $2.5 million+ condo and co-op sales are up 38% from the same period of 2023.*

Price Reductions on Active Listings

San Francisco Market Dynamics & Seasonality

Per Realtor.com Research: https://www.realtor.com/research/data/, listings posted to site. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate.

The number of price reductions typically ebbs and flows by season, but can also be affected by specific events in the economy and the market. It’s not unusual for price reductions to peak in October before the mid-winter holiday slowdown begins in mid-November.

Average Days on Market – Speed of Sale

San Francisco Market Dynamics & Seasonality

Sales reported to NorCal MLS Alliance, per Infosparks. Data derived from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

Houses (green line) continue to sell much faster than condos (blue line). Homes typically sell most quickly in spring and early autumn.

Measuring how long it takes for sold listings to accept offers. Sales in 1 month mostly reflects accepted offers in the previous month.

Overbidding List Prices in San Francisco

Percentage of Home Sales Closing over List Price

Sales data reported to NORCAL MLS® ALLIANCE, per Infosparks. Reflecting the percentage of sales closing at sales prices over the final list prices. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate, and may change with late-reported sales.

Overbidding is typically caused by buyer competition for new listings. The overall percentage for SF home sales in August 2024 fell to 49%, but the % for houses was 73%, and for condos, 28%, illustrating the different dynamics between the 2 markets.

This statistic fluctuates according to seasonal demand trends, and is a lagging indicator of market activity 3-6 weeks earlier. This statistic can be distorted by strategic underpricing strategies by listing agents.

Average Sales Price to Original List Price Percentage

San Francisco Over/Under Bidding: Market Dynamics & Seasonality

Sales reported to NorCal MLS Alliance, per Infosparks. Data derived from sources deemed reliable, but may contain errors and subject to revision. All numbers approximate, and may change with late-reported sales.

In August 2024, house sales (yellow line) averaged a sales price almost 11% over asking price, while condos (orange line) averaged a sale price 2.5% below.

Overbidding has been much more common in house sales than condo sales.

This statistic can be distorted by strategic underpricing strategies by listing agents.

Median HOUSE Sales Prices / Year-over-Year (YoY) Changes

Q2 2024, Selected U.S. Metro Areas*

| Metro Area | Median House Sales Price | Metro Area | Median House Sales Price | Metro Area | Median House Sales Price |

|---|---|---|---|---|---|

| San Jose Metro Area, CA** | $ 2,008,000 / 11.6% | Denver-Aurora- Lakewood, CO | $ 669,900 / -0.7% | Madison, WI | $ 470,800 / 9.7% |

| San Francisco Metro Area, CA** | $ 1,449,000 / 8.5% | Wash DC-Alexandria (DC, VA, MD, WV) | $ 666,600 / 6.0% | Charleston, SC | $ 457,000 / 6.2% |

| Anaheim-Santa Ana, Irvine, CA | $ 1,437,500 / 15% | Miami-W. Palm Beach-Ft Lauderdale | $ 646,000 / 6.8% | Nashville-Franklin, TN | $ 421,000 / 4.9% |

| Urban Honolulu, HI | $ 1,101,800 / 3.8% | Portland-Vancouver (OR-WA) | $ 608,500 / 1.5% | Tampa-Clearwater- St. Petersburg, FL | $ 420,000 / 2.5% |

| San Diego-Carlsbad, CA | $ 1,050,000 / 11.4% | Salt Lake City, UT | $ 583,200 / 6.6% | Minneapolis-St. Paul (MN, WI) | $ 398,300 / 3.0% |

| Boulder, CO | $ 888,300 / 2.0% | Manchester-Nashua, NH | $ 568,700 / 16.2% | Hartford, CT | $ 396,100 / 10.7% |

| Naples-Immokalee, FL | $ 867,000 / 2.0% | Sacramento- Roseville, CA | $ 555,000 / 4.7% | Chicago-Naperville- Elgin (IL, IN, WI) | $ 392,100 / 8.1% |

| Los Angeles-Long Beach-Glendale | $ 854,800 / 8.3% | Boise-Nampa, ID | $ 510,700 / 6.2% | Dallas-Fort Worth- Arlington, TX | $ 391,300 / 0.4% |

| Seattle-Tacoma-Bellevue, WA | $ 829,600 / 9.0% | Austin-Round Rock, TX | $ 496,500 / 0% | Atlanta-Marietta, GA | $ 387,800 / 3.0% |

| Boston-Cambridge-Newton, MA | $ 793,400 / 8.1% | Asheville, NC | $ 485,200 / 6.4% | Houston-Sugar Land- Woodlands, TX | $ 351,600 / 0.9% |

| Bridgeport-Stamford, CT | $ 792,800 / 9.7% | Phoenix-Mesa- Scottsdale, AZ | $ 480,400 / 3.5% | Kansas City MO, KS | $ 346,600 / 3.8% |

| New York-Newark (NY, NJ, PA) | $ 705,700 / 12.2% | Las Vegas-Paradise- Henderson, NV | $ 478,800 / 6.5% | Pittsburg, PA | $ 236,100 / 4.5% |

Financial Markets in 2023-2024

Percentage Increases in S&P 500 & Nasdaq since 1/1/23

Data per MarketWatch.com. Data from source deemed reliable but may contain errors and subject to revision. Financial market values change constantly and all numbers to be considered approximate. Financial markets are often prone to significant volatility even on a short-term basis.

VIX Volatility Index*

By Day since September 2022

*CBOE Volatility Index (VIX), per Yahoo! Finance: https://finance.yahoo.com/quote/%5EVIX/history/. Data from sources deemed reliable, but may contain errors. All numbers approximate.

“The CBOE Volatility Index, or VIX, is a real-time market index representing the [stock] market’s expectations for volatility over the coming 30 days. Investors use the VIX to measure the level of risk, fear, or stress in the market when making investment decisions.” Quote from Investopedia.

Early August 2024: Volatility in stock markets soars and then subsides (then climbs again in early September).

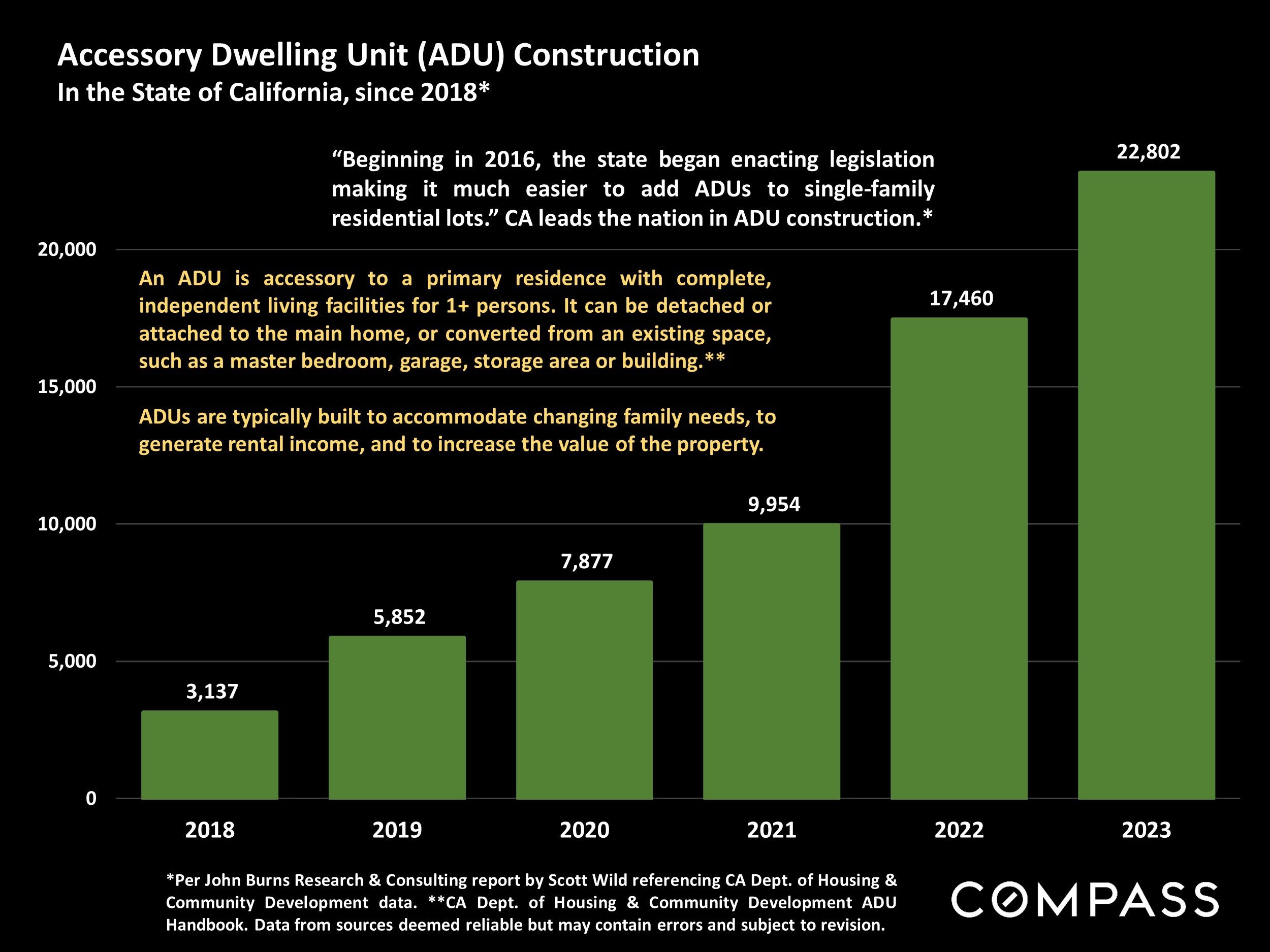

Accessory Dwelling Unit (ADU) Construction

In the State of California, since 2018*

Per John Burns Research & Consulting report by Scott Wild referencing CA Dept. of Housing & Community Development data. *CA Dept. of Housing & Community Development ADU Handbook. Data from sources deemed reliable but may contain errors and subject to revision.

"Beginning in 2016, the state began enacting legislation making it much easier to add ADUs to single-family residential lots." CA leads the nation in ADU construction.*

An ADU is accessory to a primary residence with complete, independent living facilities for 1+ persons. It can be detached or attached to the main home, or converted from an existing space, such as a master bedroom, garage, storage area or building. **

ADUs are typically built to accommodate changing family needs, to generate rental income, and to increase the value of the property.

Statistics are generalities, essentially summaries of widely disparate data generated by dozens, hundreds or thousands of unique, individual sales occurring within different time periods. They are best seen not as precise measurements, but as broad, comparative indicators, with reasonable margins of error. Anomalous fluctuations in statistics are not uncommon, especially in smaller, expensive market segments. Last period data should be considered estimates that may change with late-reported data. Different analytics programs sometimes define statistics – such as “active listings,” “days on market,” and “months supply of inventory” – differently: what is most meaningful are not specific calculations but the trends they illustrate. Most listing and sales data derives from the local or regional multi-listing service (MLS) of the area specified in the analysis, but not all listings or sales are reported to MLS and these won’t be reflected in the data. “Homes” signifies real-property, single-household housing units: houses, condos, co-ops, townhouses, duets and TICs (but not mobile homes), as applicable to each market. City/town names refer specifically to the named cities and towns, unless otherwise delineated. Multi-county metro areas will be specified as such. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers to be considered approximate.

Many aspects of value cannot be adequately reflected in median and average statistics: curb appeal, age, condition, amenities, views, lot size, quality of outdoor space, “bonus” rooms, additional parking, quality of location within the neighborhood, and so on. How any of these statistics apply to any particular home is unknown without a specific comparative market analysis.

Median Sales Price is that price at which half the properties sold for more and half for less. It may be affected by seasonality, “unusual” events, or changes in inventory and buying trends, as well as by changes in fair market value. The median sales price for an area will often conceal an enormous variety of sales prices in the underlying individual sales.

Dollar per Square Foot is based upon the home’s interior living space and does not include garages, unfinished attics and basements, rooms built without permit, patios, decks or yards (though all those can add value to a home). These figures are usually derived from appraisals or tax records, but are sometimes unreliable (especially for older homes) or unreported altogether. The calculation can only be made on those home sales that reported square footage.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.